-

USD/CAD could extend its losses toward the 1.3500 psychological support level.

-

Technical indicators suggest bearish momentum in the pair.

-

A break above the 1.3550 could reach the seven-day EMA at 1.3596.

USD/CAD extended its losses for a second straight day, trading lower near 1.3530 during the European session on Friday. A weaker US Dollar (USD) puts pressure and weakens the pair. Furthermore, a rebound in WTI prices could support the Canadian dollar (CAD), thereby putting downward pressure on the USD/CAD pair.

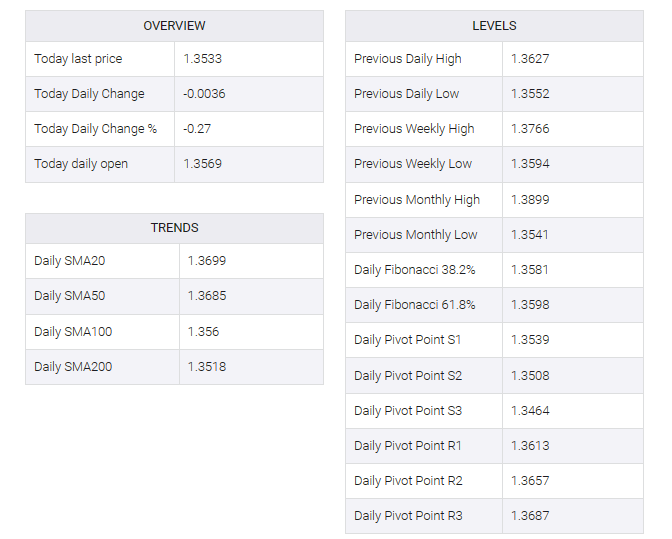

Technical indicators of the USD/CAD pair support the current downtrend. The moving average convergence divergence (MACD) line shows divergence below the centerline and below the signal line, indicating a bearish momentum in the USD/CAD pair.

Furthermore, the 14-day relative strength index (RSI) below 50 indicates a dovish sentiment, indicating that the USD/CAD pair could meet support near the emotional level around 1.3500, followed by the next support at the 1.3450 level.

On the upside, the key level at 1.3550 could act as a key barrier following the seven-day exponential moving average (EMA) at 1.3596 aligned with the psychological level at 1.3600.

A decisive advance above the latter could open the door for the USD/CAD pair to explore the barrier around the 23.6% Fibonacci retracement at 1.3621.

The US Dollar (USD) resurgence may motivate the bulls of the USD/CAD pair to target a significant level at 1.3650, with the possibility of reaching the weekly high at 1.3661 if it successfully crosses the mentioned resistance.