-

USD/CAD holds ground below 1.3550 ahead of the US data.

-

MACD suggests a potential momentum shift in the upward trajectory of the Loonie pair.

-

1.3500 psychological level emerges as the immediate support, following the 38.2% Fibonacci retracement.

USD/CAD continues its five-day losing streak, maintaining a negative bias and trading around 1.3540 during the early hours of the European session on Thursday. This downward pressure on the pair could be attributed to the rise in crude oil prices.

Market participants will likely monitor upcoming data releases from the United States (US), including the core Producer Price Index (PPI) and retail sales figures for August. These data sets will provide insight into economic activity in the US and can help traders develop their strategies for trading the USD/CAD pair.

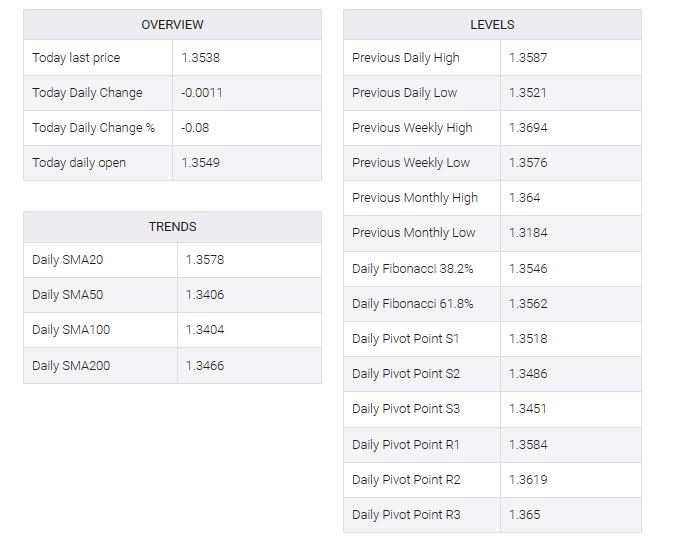

The pair may face initial support near the 1.3500 psychological level following the 38.2% Fibonacci retracement at 1.3466. A break below this level could influence the USD/CAD pair to navigate to the region below the 1.3450 psychological level.

On the upside, an immediate resistance for the USD/CAD pair is seen around the 23.6% Fibonacci retracement at 1.3553, followed by the nine-day exponential moving average (EMA) at 1.3575.

A firm break above the 1.3600 psychological level could provide support for US dollar (USD) buyers, who could potentially target the area around the weekly high at 1.3636 following the 1.3700 psychological level.

The Moving Average Convergence Divergence (MACD) line is above the center line but shows divergence below the signal line. This configuration suggests a possible momentum change in the market, which can be seen as a signal that the recent uptrend may be starting to weaken.

Traders of the USD/CAD pair will likely watch the 14-day Relative Strength Index (RSI), which does not suggest significant movement in either direction in the short term as it sits at the 50 level.