-

USD/CAD moves on a downward path as Crude oil prices improve.

-

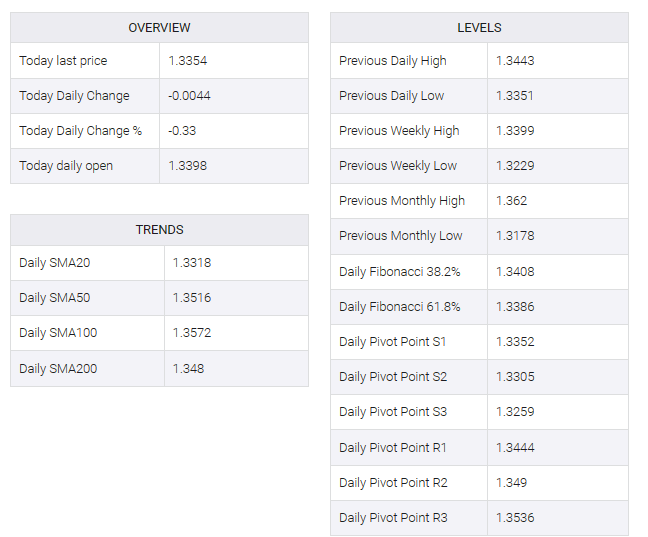

The weekly low at 1.3340 could act as immediate support followed by the psychological level at 1.3300.

-

A break above 1.3400 could prompt the pair to approach the 38.2% Fibonacci retracement level at 1.3450 and the 50-day EMA at 1.3454.

USD/CAD retook its recent gains recorded on Thursday, trading lower near 1.3350 during the European session on Friday. The Canadian dollar (CAD) is strengthening, influenced by positive movements in crude oil prices. The rise in oil prices was attributed to rising tensions in the Middle East following US and UK military strikes on Iran-backed Houthi positions in Yemen.

The weekly low at 1.3340 is seen as immediate support for the USD/CAD pair. If this level is breached, it could potentially lead the pair to test the emotional level at 1.3300, with worse prospects towards major support at the 1.3250 level.

A break below the 1.3250 level could lead the USD/CAD pair to navigate the territory near the previous week’s low of 1.3228, followed by a psychological level at 1.3200.

Technical analysis of Moving Average Convergence Divergence (MACD) for the USD/CAD pair indicates a possible trend reversal, as the MACD line is positioned below the centerline but shows divergence above the signal line.

However, the lagging indicator, the 14-day Relative Strength Index (RSI), is staying below 50. Traders will likely remain cautious and wait for confirmation, suggesting that the USD/CAD pair may be on the verge of a reversal.

The analysis suggests that on the upside, the psychological level at 1.3400 could act as key resistance. A break above the key resistance zone could take the USD/CAD pair near the 38.2% Fibonacci retracement level at 1.3450 with the 50-day exponential moving average (EMA) at 1.3450.