-

USD/CAD remains sideways around 1.3700 as the focus shifts to US labor market data.

-

The Canadian Dollar remains on the backfoot due to declining oil prices.

-

USD/CAD delivers a breakout of an inverted H&S chart pattern formed, which warrants a bullish reversal.

The USD/CAD pair traded near the round-level resistance of 1.3700 in the European session. Loonie assets are struggling for a decisive move as investors await US employment change data for September, due out at 12:15 GMT.

According to estimates, the US labor force recorded 156K new additions to personal payrolls, down from 177K in August. The US dollar index (DXY) slipped sharply after facing tough barricades near a fresh 11-month high near 107.20.

While the USD index is correcting, the USD/CAD pair is trading back and forth, indicating a weaker Canadian dollar. The latter remains on the backfoot due to falling oil prices. It is worth noting that Canada is an oil exporter to the US and lower oil prices have a negative impact on the Canadian dollar.

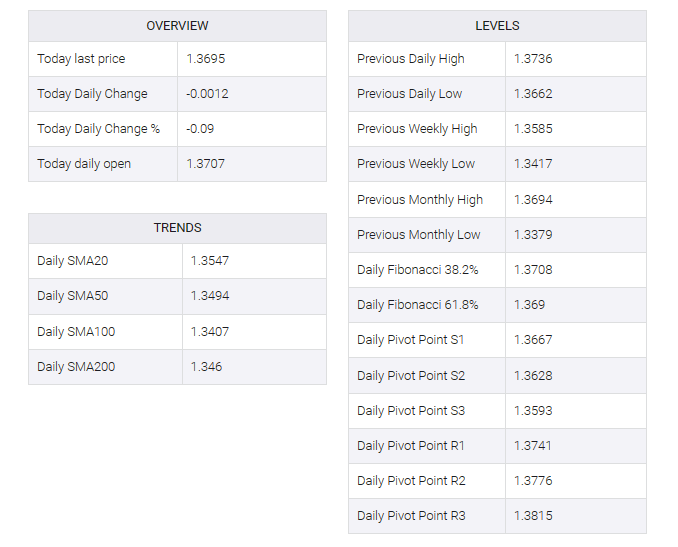

USD/CAD offers a breakout of an inverted head and shoulders chart pattern formed on the daily scale, which warrants a bullish reversal after a prolonged consolidation. The neckline of the aforementioned chart pattern was plotted at the 1.3668 high from April 28. The 50-day exponential moving average (EMA) at 1.3500 continues to provide a cushion to US dollar bulls.

The Relative Strength Index (RSI) (14) shifts into the bullish range of 60.00-80.00, which indicates an activation of the bullish impulse.

A decisive break above October 3 high at 1.3736 would expose the asset to March 24 high around 1.3800, followed by March 10 high at 1.3860.

In an alternate scenario, a breakdown below September 25 low around 1.3450 would drag the asset toward September 20 low near 1.3400. A further breakdown could expose the asset to six-week low near 1.3356.