-

USD/CAD loses ground around 1.3575 despite the rebound of USD.

-

US ISM Services PMI arrived at 52.7 in November vs. 51.8 prior, above the market consensus.

-

Bank of Canada (BoC) to hold interest rate steady at 5.0% at its December meeting.

-

US ADP Employment Change, BoC monetary policy meeting will be in the spotlight on Wednesday.

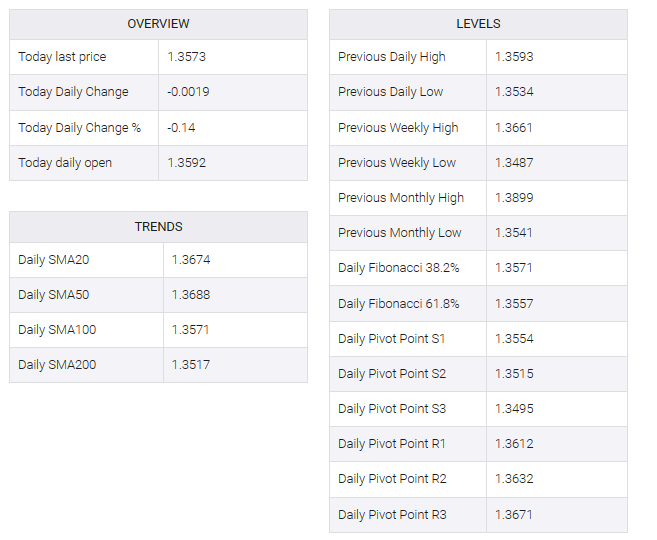

The USD/CAD pair snaps the two-day winning streak during the early European session on Wednesday. The pair remains capped under the 100-day Exponential Moving Average (EMA) around 1.3600. The pair attracts some sellers despite the recovery of the US Dollar (USD) Index. USD/CAD currently trades near 1.3575, down 0.12% on the day.

US data on Tuesday revealed that the ISM Services PMI came in at 52.7 in November, better than market expectations of 52.0 from the previous reading of 51.8. Meanwhile, US JOLTS labor data on Tuesday was worse than expected. US job openings, as measured by the Job Openings and Labor Turnover Survey (JOLTS), fell by 617,000 to 8.733M in October. This report indicated that US labor market conditions are easing further.

The Federal Reserve (Fed) maintained its stance while saying that the possibility of additional policy tightening cannot be ruled out. However, market participants believe the Fed is done with the hiking cycle and will start cutting rates in March next year. This, in turn, could limit the US dollar’s upside and act as a headwind for the USD/CAD pair.

On the loonie front, the Bank of Canada (BOC) will announce its interest rate decision on Wednesday. BoC Governor Tiff Macklem said higher interest rates cooled the overheated economy and took steam out of inflation. Macklem believes the central bank has done enough to control inflation but the BoC will raise rates again if inflation persists. Markets expect the BoC to keep interest rates steady at 5.0% at its December meeting.

Meanwhile, a rebound in oil prices could lift the commodity-linked loonie, as the country is the top oil exporter to the US.

Market players will monitor US ADP employment changes and unit labor costs (Q3). Attention will shift to the BoC interest rate decision later on Wednesday. These events can trigger volatility in the market and give a clear direction to the USD/CAD pair.