-

USD/CAD is set to finish the week flat after solid US economic data.

-

The US ISM Services PMI came in slightly below estimates, although it remains in expansion territory.

-

The Bank of Canada is expected to keep rates unchanged at 4.50% at the upcoming monetary policy meeting.

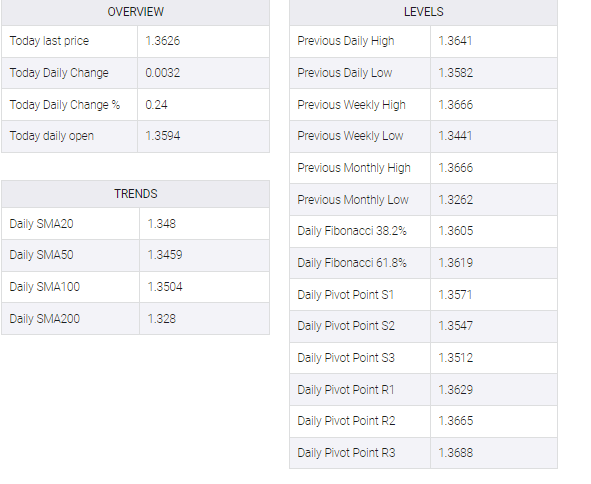

The USD/CAD cements its bullish case by staying above the 1.3600 figure, courtesy of falling Oil prices. Heated discussions within the Organization of the Petroleum Exporting Countries (OPEC) sent WTI prices down almost 3%, a headwind for the Canadian Dollar (CAD). At the time of writing, the USD/CAD is trading at 1.3625.

USD/CAD reached 1.3630s post US ISM Non-Manufacturing PMI

Wall Street opened in positive territory. The US ISM Non-Manufacturing PMI for February came out at 55.1, below the prior’s month 55.2, but exceeded estimates of 54.5, signaling that activity remains firm. The Prices Paid Index subcomponent, estimated to drop to 64.5, rose by 65.6, below January’s 67.8, higher than expected, but it shows an improvement compared to the last month.

After the ISM’s release, the US Dollar Index (DXY), a measure of the buck’s value, improved toward 104.924, trimmed some of its earlier losses, and is almost flat, while the USD/CAD jumped 15 pips from around 1.3615 to 1.3630s.

US Federal Reserve’s (Fed) speakers highlighted the importance of tackling inflation towards the 2% target. On Thursday, Fed Governor Christopher Waller commented that inflation was not easing as expected and signaled his openness to increase rates if price pressures don’t reduce.

In the meantime, the Wall Street Journal reported that the United Arab Emirates (UAE) is having an internal debate about leaving OPEC, as the country has been seeking authorization to increase its crude output. Consequently, WTI fell 3% towards three-day lows before recovering some ground.

On the Canadian front, Building Permits – a leading indicator for the economy – fell by 4% in January from December and were down 5% YoY, according to data revealed by Statistics Canada. The fall was spurred by aggressive rate hikes of the Bank of Canada (BoC).

The BoC announced that it would pause its tightening cycle and is expected to hold it at around 4.50% at its next meeting.

Hence, USD/CAD is expected to rise further, although analysts anticipate a stronger Canadian dollar for the year. An improving global economic outlook will undermine USD/CAD, as traders looking for a return will turn to higher beta currencies such as the loonie (CAD). In an alternative scenario, the interest rate differential between the Fed and the BoC would likely favor the US dollar; Hence further upside is forecast in USD/CAD.

Also read:

- Breaking: US ISM Services PMI edges lower to 55.1 in February vs. 54.5 expected

- Crude oil sinks on reports UAE could leave OPEC