-

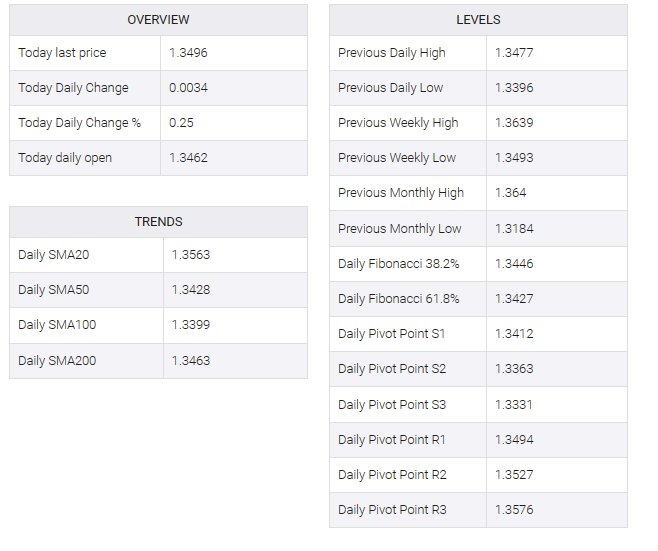

USD/CAD gains traction around 1.3485 amid the renewed USD demand.

-

The Federal Reserve (Fed) maintained interest rates and indicated a possible further hike before year-end.

-

A decline in oil prices exerts pressure on the Canadian Dollar (CAD).

-

Market players await US weekly Jobless Claims, Canadian Retail Sales due later this week.

USD/CAD extended its gains and traded in positive territory for the second day in a row in the early Asian session on Thursday. The pair’s rebound was supported by the Federal Reserve’s (Fed) policy meeting on Wednesday and expectations of revised interest rates for 2024. The pair is currently trading near 1.3485, having gained 0.18% on the day.

At its September meeting, the Federal Reserve (Fed) kept interest rates unchanged at 5.25-5.50% as widely expected in the market. Officials are becoming more confident that they can reduce inflation without hurting the economy or causing major job losses.

In a press conference, Fed Chairman Jerome Powell reiterated the Fed’s commitment to achieving 2% inflation. He added that keeping rates on hold does not indicate the Fed’s policy stance and that the US central bank is prepared to raise rates if necessary. According to the Fed’s most recent quarterly forecast, the benchmark overnight interest rate could be raised once more this year to a peak range of 5.50% to 5.75%, and rates could be significantly tighter than previously expected by 2024.

Additionally, the Fed revised its Summary of Projections (SEP), indicating that Fed officials estimate interest rates to hit 5.1% by the end of 2024 (from 4.6% previously). The prolonged high rate narrative has driven the US dollar against its rivals and acted as a tailwind for the USD/CAD pair.

On the loonie front, falling oil prices weakened the commodity-linked loonie as the country is the top oil exporter to the US. Data released on Tuesday showed that the Canadian Consumer Price Index (CPI) rose 3.3% YoY in July from 4.0% YoY in August. Meanwhile, core CPI which excludes volatile oil and food prices rose to 3.3% YoY from the previous reading of 3.2%. These figures could convince the Bank of Canada (BoC) to raise interest rates further.

In a speech following the data release, BoC Deputy Governor Sharon Kozicki said the size of the volatility we’ve seen in the past few months is not unusual given the central bank’s focus on measures of core inflation.

Looking ahead, US weekly jobless claims, the Philly Fed, and existing home sales will be out on Thursday. On Friday, preliminary US S&P global PMIs for September and Canadian retail sales for July will be released. Traders will take cues from this data and find trading opportunities around the USD/CAD pair.