-

USD/CAD jumped to near 1.3700 as US Retail Sales remained robust in September.

-

The Canadian Dollar weakened as soft inflation data prompted hopes of a steady BoC policy.

-

The market mood remains cautious amid deepening Middle East tensions.

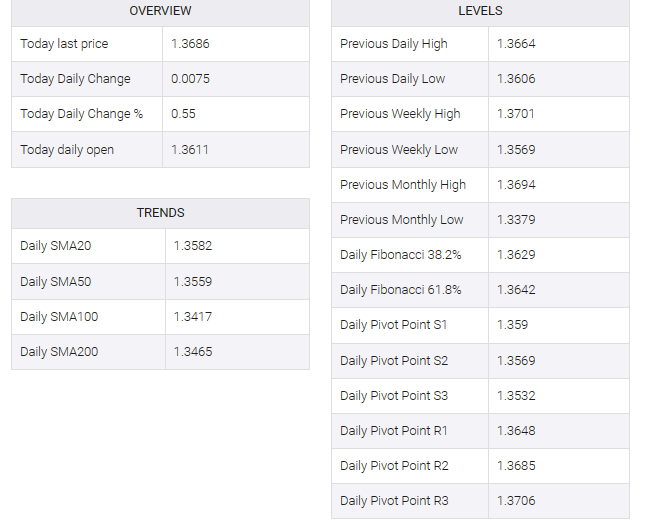

The USD/CAD pair finds stellar buying interest and jumps to near the round-level resistance of 1.3700 after the United States Census Bureau reported robust consumer spending data and Statistics Canada reported a decline in price pressures in September.

US retail sales expanded at a strong pace of 0.7%, boosted by higher automobile demand and spending on dining out. Economic data excluding automobiles rose 0.6%, almost double the pace expected. Strong retail demand could raise consumer inflation expectations and create unease for Federal Reserve (Fed) policymakers.

After the US retail sales data, the US dollar index (DXY) recovered strongly near 106.50. Interest rate expectations of 5.25-5.50%, however, appear unchanged for November monetary policy as Fed policymakers see high long-term bond yields as sufficient to limit spending and investment.

Going forward, the US dollar will dance to the tune of Fed Chair Jerome Powell’s speech, scheduled for Thursday. Fed Powell is expected to hint at possible monetary policy moves.

Market mood remains subdued amid deepening Middle East tensions. The continued risk of Iranian and Yemeni intervention in the Israeli-Palestinian conflict could worsen the situation.

On the Canadian dollar front, declining consumer inflation expected the Bank of Canada (BoC) to keep interest rates unchanged. The monthly headline and core consumer price index (CPI) contracted by 0.1% while investors had forecast a 0.1% rise. Annual headline and core CPI softened by 3.8% and 2.8% respectively.