-

USD/CAD advances to near 1.3350 as investors’ risk-appetite fades.

-

The FOMC minutes will provide outlook on inflation and interest rates.

-

Canadian jobless rate is seen higher at 5.9% vs. 5.8% in November.

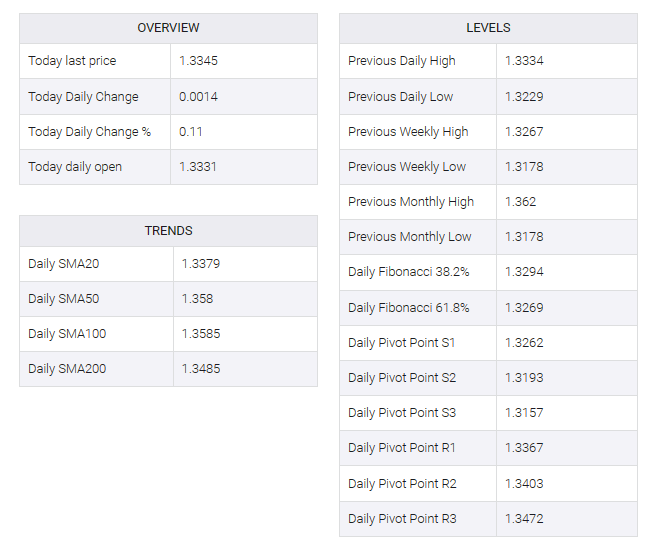

In the late London session the USD/CAD pair hovered near the key resistance at 1.3350. Loonie assets recovered quickly, following in the footsteps of the US Dollar Index (DXY) amid caution among market participants ahead of the Federal Open Market Committee (FOMC) minutes and US ISM Manufacturing PMI December.

S&P500 futures produced nominal losses in the European session, illustrating a further reduction in risk-appetite among market participants. The USD index edged closer to 102.50 as the prospect of a potential rate cut decision by the Federal Reserve (Fed) from March eased. 10-year U.S. Treasury yields extended their gains to near 4%.

The FOMC minutes will show how eager policymakers are to cut interest rates. Meanwhile, US factory data will be closely watched. According to preliminary estimates, the manufacturing PMI is seen higher at 47.1 from the previous reading of 46.7 but will remain below the 50.0 threshold for the 14th consecutive month.

In addition, US JOLTS job openings will be the focus for November. Investors estimated that US employers posted 8.85M jobs, up from the 8.733M postings recorded in October.

On the Canadian Dollar front, investors await the employment data for December, which will be published on Friday. As per the estimates, the Unemployment Rate rose to 5.9% against the former reading of 5.85. Number of job-seekers employed by Canadian employers were 13.5K, lower than 24.9K additions in November.