-

USD/CAD fell to lowest level since November amid prevailing USD selling bias.

-

Expectations that the Fed will cut interest rates later this year weigh on the Greenback.

-

The overnight slump in oil prices undermines the Loonie and might help limit the slide.

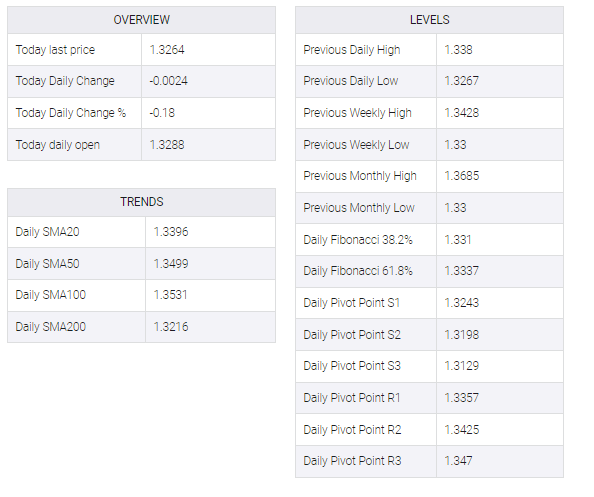

The USD/CAD pair remains under some selling pressure for the third successive day on Thursday and drops to its lowest level since November 16 during the first half of the European session. The pair currently trades around the 1.3265 region and seems vulnerable to prolong its downward trajectory amid sustained US Dollar weakness.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, hits a fresh nine-month low and is pressured by a less-hawkish Fed. As was widely expected, the US central bank decided to raise the policy rate by 25 bps and reiterated its commitment to keep hiking interest rates high to cool price pressures. Comments from the Fed Chairman Jerome Powell at the press conference afterwards, however, suggesting there were signs interest rates were having a “disnflationary” effect, flipped the narrative, weighing on the buck and acting as a headwind for the USD/CAD pair.

From a CAD perspective, the overnight slump in crude oil prices – to a three-week low – weakened the commodity-linked loonie and gave some support to the USD/CAD pair. Apart from this, a cautious market mood, along with a slight rise in US Treasury bond yields, helped limit losses for the greenback. As a result, bearish traders are preventing fresh bets around the major, although acceptance below the 1.3300 mark supports the possibility of further bearish moves. Hence, a decline to November 2022 lows around the 1.3230-1.3225 area looks a distinct possibility.

Market participants now look to the release of the Weekly Initial Jobless Claims from the US, due later during the early North American session. The data might influence the USD, which, along with Crude Oil price dynamics, should provide some impetus to the USD/CAD pair. The focus, however, will remain glued to the closely-watched US monthly jobs report – popularly known as NFP on Friday.