-

USD/CAD attracts some buyers near the 1.3630 region on Tuesday amid a modest USD rebound.

-

A fresh leg up in the US bond yields turns out to be a key factor lending support to the Greenback.

-

Bullish Crude Oil prices could underpin the Loonie and keep a lid on any further gains for the pair.

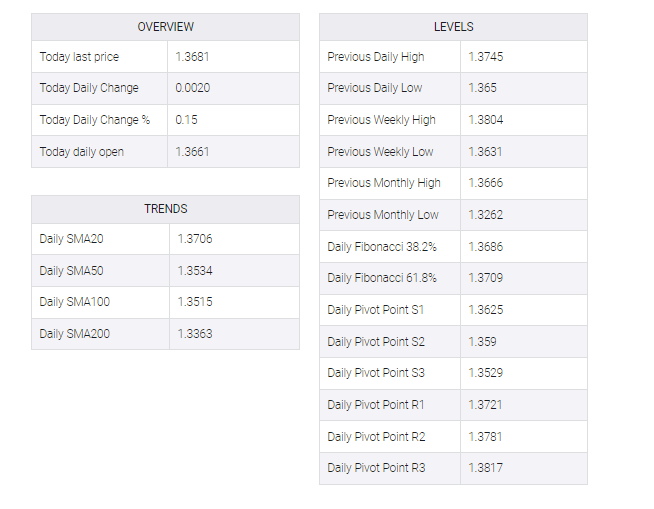

The USD/CAD pair rebounded nearly 50 pips from the 1.3630 region on Tuesday and touched a new daily peak in the first half of the European session. The pair is currently held around the 1.3675-1.3580 area and, for now, last week’s pullback from levels just above the 1.3800 round-figure mark appears to have stalled.

The intraday rise can be attributed to a modest US dollar (USD) bounce from two-day lows, supported by a fresh leg-up in US Treasury bond yields. The acquisition of Silicon Valley Bank by First Citizens Bank & Trust Company from the Federal Deposit Insurance Corporation (FDIC) eased fears of a full-blown banking crisis. Adding to this, regulators have assured that they are ready to deal with any liquidity shortages and push US bond yields higher. That said, the Federal Reserve’s signal last week that it may soon pause the rate-hiking cycle given the recent turmoil in the banking sector could cap the USD.

It is noteworthy that the US central bank raised interest rates by 25 bps on Wednesday, as widely expected, although it remained cautious on the outlook. Furthermore, a generally positive risk tone around equity markets may also contribute to putting a lid on meaningful gains for the safe-haven greenback. Apart from this, another positive development in crude oil prices, which is at a two-week high, could underpin the commodity-linked and act as a headwind for the USD/CAD pair. Consequently, it takes some caution before placing aggressive bullish bets around the main and positioning for any subsequent intraday strength.

Market participants now look to the US economic docket, featuring the release of the Conference Board’s Consumer Confidence Index and the Richmond Manufacturing Index. Apart from this, the US bond yields and the broader risk sentiment will drive the USD demand. This, along with Oil price dynamics, could produce short-term trading opportunities around the USD/CAD pair. The market focus will then shift to the release of the final US Q4 GDP print on Thursday, which will be followed by the monthly Canadian GDP and the Fed’s preferred inflation gauge – the Core PCE Price Index – on Friday.