-

USD/CAD recovers early lost ground amid a modest USD recovery from the daily low.

-

Fears of a full-blown banking crisis drive some haven flows and benefit the Greenback.

-

An intraday move up in Oil prices could underpin the Loonie and cap any further gains.

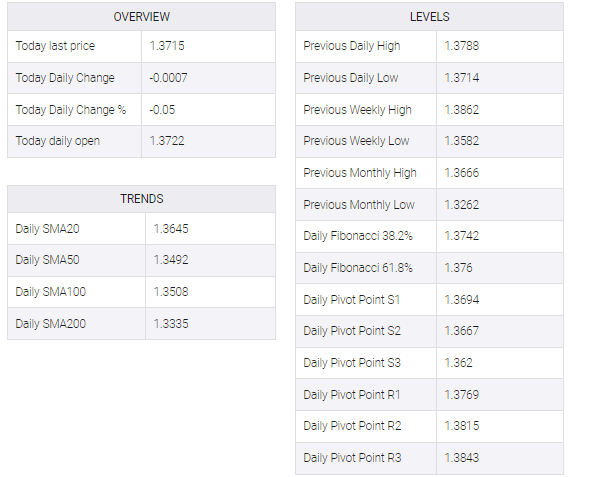

The USD/CAD pair attracts some deep-bay near the region of 1.3680-1.3675 on Friday and now reverses a large part of the damage to its intrade. The pair rise above the 1.3700 round-fig mark in the mid-European session, though the intrade ups do not have a bullish suffix.

In the hope of strong recovery in the demand for Chinese fuel, the price of crude oil returns to the positive traction on the last day of the week and moves down from the lower 15 months on Thursday. As a result, it is seen to underpin the commodity-linked loi and acts as a headwind in a moderate US dollar weakness for the USD/CAD pair. The US is expected to take a less aggressive aggressive position in terms of the deterioration of economic conditions.

Last week two medium -sized US banks – Silicon Valley Bank and Signature Bank Fall – The US central bank forced investors to reduce the bet to tighten more aggressive policies. In fact, markets are now setting prices on a small 25 BPS lift-off at the upcoming FOMC monetary meeting on March 21-22. It turns out to be an original factor in exerting the downward pressure on the dump from the bottom of a fresh leg yield of US Treasury bonds.

It says that a generally weak risk tone drives some heaven flow towards the greenback and helps bring the USD/CAD pair back to the primary lost ground. Despite the multi-billion-dolar lifeline for the United States and Europe, investors are worried about the possibility of widespread infection and a full-fledged global banking crisis. It, with the fear of recession, has an impact on the feeling of global risk and facilitating the traditional safe-barren currency.

Furthermore, the fact that the Bank of Canada (BoC) became the first major central bank to pause its rate-hiking cycle last week could undermine the Canadian Dollar. This, in turn, suggests that the path of least resistance for the USD/CAD pair is to the upside and supports prospects for a move back towards reclaiming the 1.3800 mark. Traders now look to the release of the Michigan US Consumer Sentiment Index to grab short-term opportunities heading into the weekend.