-

USD/CAD is facing hurdles to extend its recovery above 1.3740, with volatility expected ahead of US inflation.

-

Federal Reserve could continue a smaller rate-hike regime to avoid the United States recession.

-

Bank of Canada may be required to resume its policy-tightening process to tame inflation recovery.

-

USD/CAD might display a downside momentum if RSI (14) skids into the bearish range of 20.00-40.00.

The USD/CAD pair is facing barricades while extending its recovery above the immediate resistance of 1.3740 in the early European session. A sideways performance is expected from the Loonie asset till the release of the United States Consumer Price Index (CPI) data. Earlier, the asset rebounded after a five-day low of 1.3677 as investors got anxious ahead of the US inflation release and improved appeal for safe-haven assets.

The US Dollar Index (DXY) is showing forward action below 104.00. The USD index seems to be gathering strength to extend its recovery as the US inflation release will pave the way for an interest rate decision from the Federal Reserve (Fed), which is scheduled for next week. S&P500 futures are trying to hold on to gains generated in the Asian session.

However, risk appetite remains weak as global stocks continue to take heat from the decline of Silicon Valley Bank (SVG). The yield on the 10-year US Treasury bond returned to around 3.57% on hopes that US inflation data could boost safe-haven appeal.

Upside risks to US inflation look favorable

The main catalyst of the week – US Inflation, will be released on Tuesday and is expected to provide power-packed action in the FX domain. Given the resilience of aggregate demand, the strong employment bill and the optimistically strong labor market, an acceleration of US inflationary pressures cannot be ruled out. Last week, the US Bureau of Labor Statistics reported a significant jump in payrolls generated by the US economy in February. The unemployment rate rose to 3.6%. And, average hourly earnings rose 4.6%, below the consensus of 4.7%.

Despite the rising unemployment rate, the US labor market looks buoyant as companies continue to ramp up their hiring processes to add more people. And, employment bills are still on an upward trend, indicating that households are equipped with sufficient funds to trigger inflation again.

Analysts at Wells Fargo expect “another monthly increase of 0.4% in overall CPI in February, which would put the annual rate at 6.0%. We still see inflation coming down, but the process may be slow and will take time. Despite some directional improvements over the past few quarters, prices are still rising well above the Fed’s 2% target, and the tight labor market suggests there are still inflationary pressures that could lead to a full return to 2% inflation.”

Labor market buoyed to force Bank of Canada to rollback rate-hiking process

The Bank of Canada (BOC) has already confirmed that current monetary policy is sufficiently restrictive to control Canadian inflation. BoC Governor Tiff Macklem decided to allow the current monetary policy to demonstrate its potential and therefore kept monetary policy steady in March. However, a surprise increase in employment numbers and a higher employment cost index indicate that inflation may be driving up again. Along with an unchanged monetary policy, Bank of Canada Tiff McCollum left room open for higher rates if inflation spooked.

Meanwhile, oil prices witnessed a sell-off as the street worried about aggregate demand ahead. It is worth noting that Canada is a leading exporter of oil to the US and lower oil prices will affect the Canadian dollar.

USD/CAD technical outlook

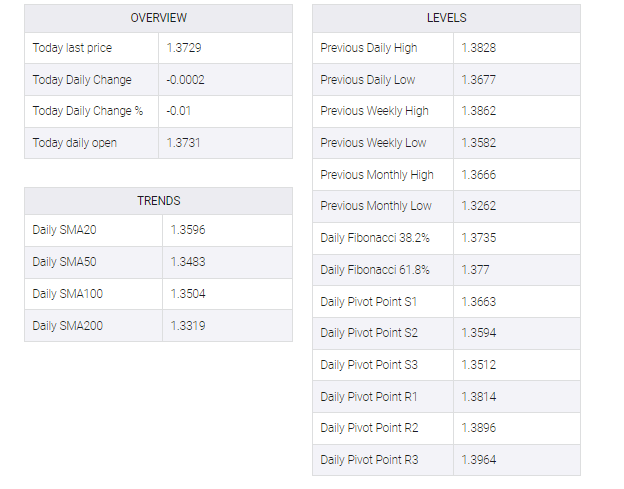

USD/CAD has delivered a sheer downside move after a breakdown of the Head and Shoulder chart pattern formed on a two-hour scale. The asset rebounded but has now found barricades near the horizontal resistance plotted from March 08 low at 1.3745. The US Dollar bulls are expected to find a cushion near support placed from March 01 high at 1.3659.

The 20-period Exponential Moving Average (EMA) at 1.3745 is expected to act as a major resistance for the US Dollar.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range. A breakdown into the bearish range of 20.00-40.00 will trigger the downside momentum.