-

USD/CAD defended the 100-day SMA and rebounded from the one-month low touched on Thursday.

-

Looming recession risks weigh on investors’ sentiment and benefit the safe-haven greenback.

-

An uptick in oil prices could underpin the Loonie and cap any meaningful gains for the major.

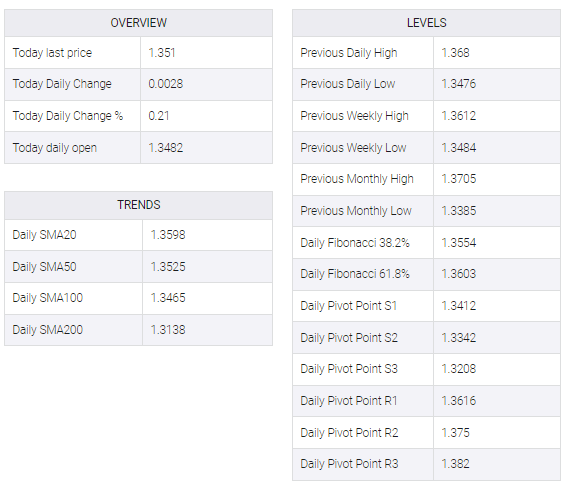

The USD/CAD pair attracts some buyers in the vicinity of the 100-day SMA support and stages a modest bounce from a one-month low touched earlier this Thursday. The pair sticks to its intraday recovery gains through the early European session and is currently placed just above the 1.3500 psychological mark.

A softer risk tone helps the safe haven US dollar regain some positive traction, which in turn, pushes the USD/CAD pair higher. Despite the easing of strict COVID-19 restrictions in China, concerns of a deep global economic slowdown continue to weigh on investor sentiment and put a lid on any optimism in the market. That said, a combination of factors could prevent USD bulls from placing aggressive bets and cap the upside for the major, at least for now.

Minutes of December’s FOMC policy meeting showed that officials unanimously supported raising borrowing costs at a slower pace. US Treasury bond yields remained within striking distance of touching three-week lows on Wednesday, bolstering the prospect of a small rate hike by the Fed. This will act as a headwind for the USD. In addition to this, a rise in crude oil prices could impact the commodity-linked loonie and trigger a warning for USD/CAD bulls.

Traders now look to the US economic docket, featuring the release of the ADP report on private-sector employment and the usual Weekly Initial Jobless Claims. This, along with the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to the USD/CAD pair. Apart from this, oil price dynamics could contribute to producing short-term trading opportunities. The focus, however, remains on monthly employment details from the US and Canada, due on Friday.