-

USD/CAD faces challenges on improved Crude oil prices.

-

WTI improves on speculation that OPEC may decide on more production cuts.

-

CPI Canada is anticipated to have eased at 3.2% in October.

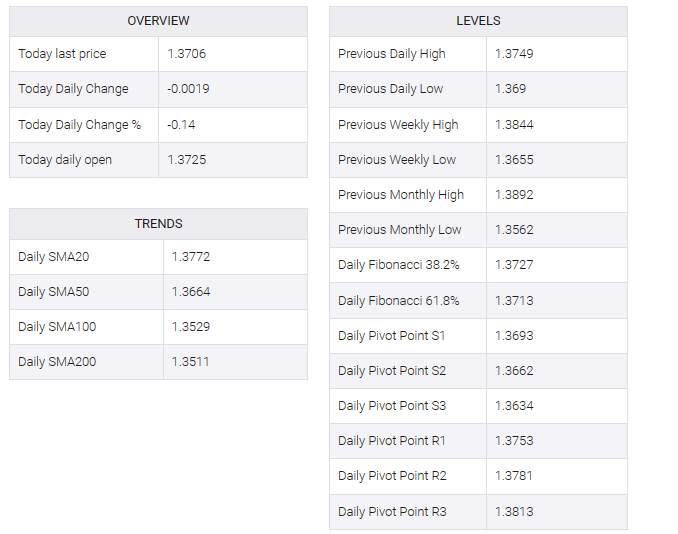

USD/CAD recovered its recent gains, trading lower near 1.3710 in the Asian session on Tuesday. The Canadian dollar (CAD) finds upside support against the greenback due to higher crude oil prices.

West Texas Intermediate (WTI) was trading near $77.50 a barrel by press time. Market speculation suggests that the Organization of the Petroleum Exporting Countries (OPEC) may decide to further cut production at its upcoming meeting on November 26.

Canada’s Consumer Price Index (CPI) data will be released on Tuesday. The annual inflation rate is expected to have eased to 3.2% in October from 3.8% previously. A drop in inflation may give the Bank of Canada (BoC) room to keep its target for the overnight rate unchanged at 5.0% at its December meeting, especially as the central bank indicated that rate decisions will be influenced by economic indicators.

The US Dollar (USD) faces challenges as elevated risk appetite prevails, driven by expectations of a dovish stance from the Federal Reserve (Fed). Last week’s release of soft inflation figures, with the Consumer Price Index (CPI) falling to 3.2% (YoY) and core CPI to 4.0% (YoY), led investors to reconsider the possibility of a rate hike at the December meeting and consider a possible rate cut in 2024.

Traders will closely monitor key US economic indicators, including Existing Home Sales and the Chicago Fed National Activity Index on Tuesday. Additionally, insights from the Federal Reserve’s minutes from its recent meeting are eagerly awaited by market participants.