-

USD/CAD seems to surpass the psychological level at 1.3600.

-

Upbeat WTI price could provide support for the Canadian Dollar (CAD).

-

Stronger US labor data have triggered discussions on the trajectory of Fed monetary policy.

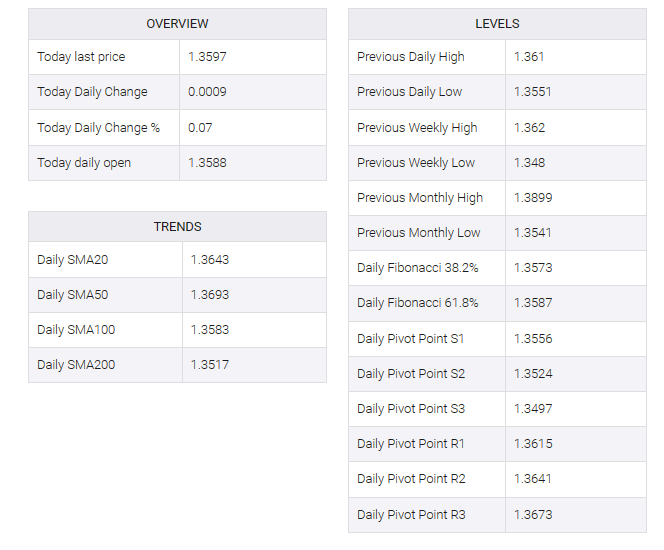

USD/CAD recovers its recent losses as the US dollar (USD) tries to gain ground for the second day in a row. The USD/CAD pair traded higher around 1.3600 during the Asian session on Monday. However, stronger crude oil prices may limit the Canadian dollar’s (CAD) losses.

West Texas Intermediate (WTI) extended its winning streak for a third consecutive session, trading near $71.60 a barrel in the Asian session on Monday. Crude oil prices rose after the release of data last week, which indicated some resilience in the United States (US) economy. Friday’s strong US jobs data played a key role, portraying the labor market as one of the few positives in the world’s largest energy consumer.

US nonfarm payrolls for November showed a significant increase, reaching 199,000 compared to October’s increase of 150,000 and beating market expectations of 180,000. US average hourly earnings (YoY) were steady at 4.0%, in line with market estimates for November. The unemployment rate dropped to 3.7% from 3.9% earlier.

The robust employment data has stirred conversations regarding the future trajectory of the US Federal Reserve’s (Fed) monetary policy and how long the central bank plans to maintain rates at restrictive levels. This surge in discussions has fueled an upward movement in US Treasury yields, contributing to the strengthening of the USD. Market participants are now focused on the US Consumer Price Index (CPI) on Tuesday and the Fed Interest Rate Decision on Wednesday for further insights and potential market impact.