-

USD/CHF consolidates around 0.9050 amid uncertainty over the Fed’s interest rate peak.

-

The SNB kept interest rates unchanged at 1.75% for the first time since March 2022.

-

Going forward, investors will focus on US S&P Global PMIs for September.

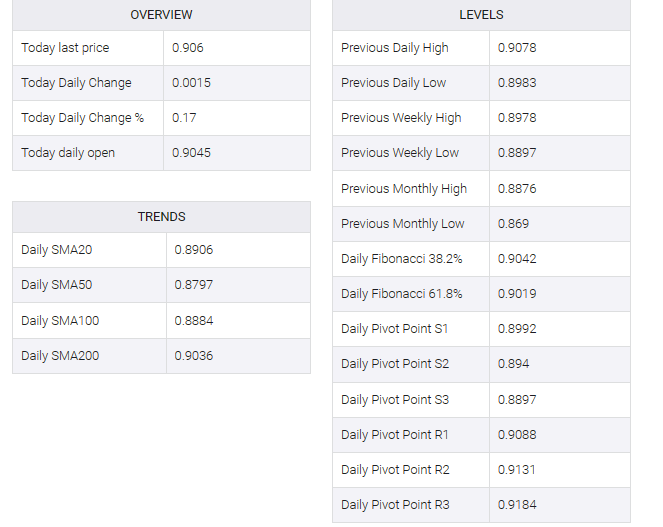

The USD/CHF pair traded in a narrow range around 0.9050 in the late European session. The Swiss franc asset remained largely bullish as the Swiss National Bank (SNB) announced a steady interest rate decision on Thursday, keeping interest rates at 1.7% while investors expected a 25 basis point (bps) rate hike to 2%.

SNB Chairman Thomas J. Jordan and other policymakers decided to provide a fixed monetary policy for the first time from March 2022 when the central bank begins its rate-cutting cycle to ease inflationary pressures.

Regarding the interest rate outlook, the SNB has left the door open for further policy tightening. SNB Jordan cited that the current inflation situation has given us time to assess whether the measures taken so far are sufficient to keep inflation comfortably below 2%.

Meanwhile, S&P500 futures generated some modest gains in the London session, illustrating a nominal improvement in risk-averse asset appeal. The US Dollar Index (DXY) displayed a sideways trend as uncertainty about a possible hike in interest rates followed a dovish outlook from the Federal Reserve (Fed).

The USD index’s upside appears limited for now as investors see no sign of the Fed’s November monetary policy hike. Going forward, investors will focus on September’s preliminary PMI from S&P Global, due out at 13:45 GMT.

According to a preliminary report, The Manufacturing PMI is seen improving marginally to 48.0 from the August reading of 47.9. The Services PMI, which tracks a sector that accounts for two-thirds of the US economy, is anticipated to rise to 50.6 from 50.5 in August.