-

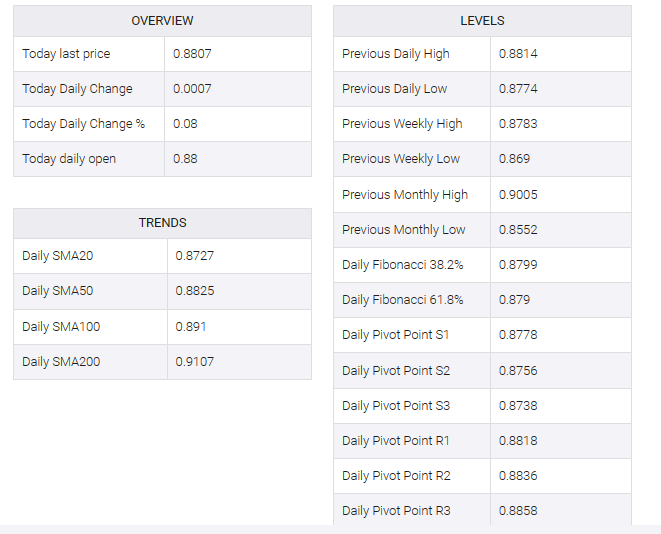

USD/CHF gains momentum around the 0.8800 mark, bolstered by the strengthening of the Dollar.

-

The FOMC Minutes emphasised that inflation remained unacceptably high.

-

The American bipartisans support imposing higher tariffs on Chinese imports.

-

Investors await the US weekly Initial Jobless Claim, the Philadelphia Fed Manufacturing Survey (Aug) due on Thursday.

The USD/CHF pair edged higher in the 0.8800 area at the start of Asian trading hours on Thursday. Meanwhile, the US Dollar Index (DXY), a measure of the USD’s value against six other major currencies, extended its gains above 103.45, its highest level since June.

The minutes of the July meeting of the Federal Open Market Committee (FOMC) emphasized that inflation remains unacceptably high. Fed officials see significant inflationary risks, and additional tightening of monetary policy may be needed to bring inflation to the long-term target.

Economic data released on Wednesday showed that US industrial production rose 1.0% in July, beating market expectations of 0.3% and an earlier decline of 0.8%. In July, building permits rose to 1.44 million from 1.44 million, while housing starts rose to 1.45 million from 1.39 million in June, beating expectations of 1.48 million. Both changes in building permits and changes in housing starts exceeded both market expectations and prior readings. The US dollar gained momentum across the board, supported by the hawkish statement from the FOMC and upbeat US data.

The Swiss Federal Statistical Office reported on Tuesday that producer and import prices in July came in at -0.6%, against expectations of 0.5%. On a monthly basis, the figure narrowed to 0.1% vs. 0.1% earlier. According to Bloomberg, the Swiss National Bank (SNB) will raise interest rates by 25 basis points (bps) to 2% at its September meeting.

On Wednesday, the American bipartisans supported imposing higher tariffs on Chinese imports and believed that the US must intensify preparations for military threats from China, according to a new Reuters/Ipsos survey. The renewed tension between the US and China might benefit the safe-haven Swiss Franc and act as a headwind for the USD/CHF pair.

In the absence of any relevant market-moving economic releases from Switzerland, the USD/CHF pair remains at the mercy of USD price dynamics. The US weekly Initial Jobless Claims for the week ending August 11 and the Philadelphia Fed Manufacturing Survey for August will be due in the American session. Traders will also focus on the US-China tension headlines for fresh cues.