-

USD/CHF loses ground as the Fed is expected to lower interest rates in early 2024.

-

The demand for the Swiss Franc is heightened on risk aversion due to the Middle-East conflict.

-

CME Fedwatch tool indicated that markets are pricing in the probability of a Fed rate cut in March and in May.

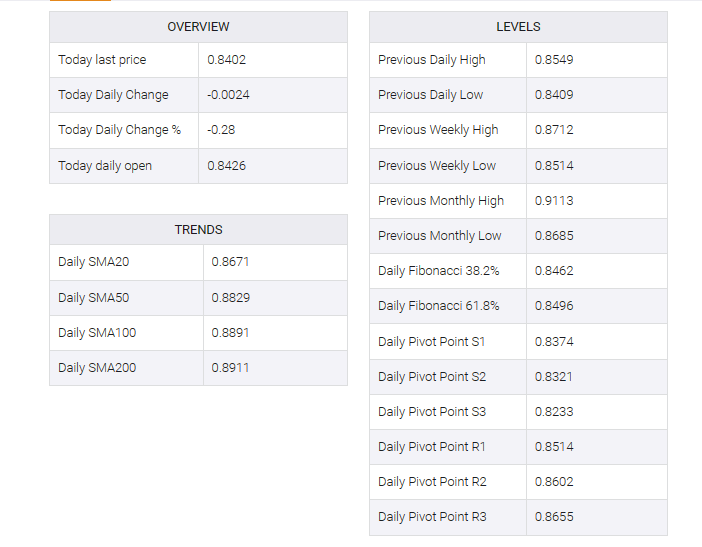

USD/CHF posted an all-time low of 0.8394 during Asian trading hours on Thursday, trading around 0.8400 at the time of writing. USD/CHF faces challenges due to weak US dollar (USD). The heightened geopolitical situation in the Middle East is encouraging risk aversion, increasing demand for the safe-haven Swiss franc (CHF).

Investors seek refuge in assets such as the CHF during times of heightened geopolitical tension. Concerns center particularly around the possible closure of the Strait of Gibraltar by Iran, adding to geopolitical uncertainty. However, major shipping companies are beginning to return to the Red Sea, indicating a temporary normalization in the region.

According to the CME FedWatch tool, markets are more than 88% likely to price a rate cut in March and fully priced in a rate cut in May. These figures indicate expectations among investors for possible monetary policy easing by the Federal Reserve (Fed).

Additionally, the softer US Core Personal Consumption Expenditures (PCE) – inflation further reinforces the belief that the Federal Reserve may contemplate easing its monetary stance to address economic conditions. On Wednesday, the US Richmond Fed Manufacturing Index experienced a notable decrease of 11 points in December, contrary to the expected decrease of 7 points and a 5-point decrease in November.

Investors are anticipated to focus on Thursday’s releases of Initial Jobless Claims and Pending Home Sales from the United States, which could offer additional insights into the labor market and the real estate sector, respectively.