-

USD/CHF jumps to near 0.8750 as the US Dollar roars ahead of factory data.

-

Global recession fears improve the appeal of the US Dollar Index,

-

Swiss markets remain closed on Tuesday on account of a National Holiday.

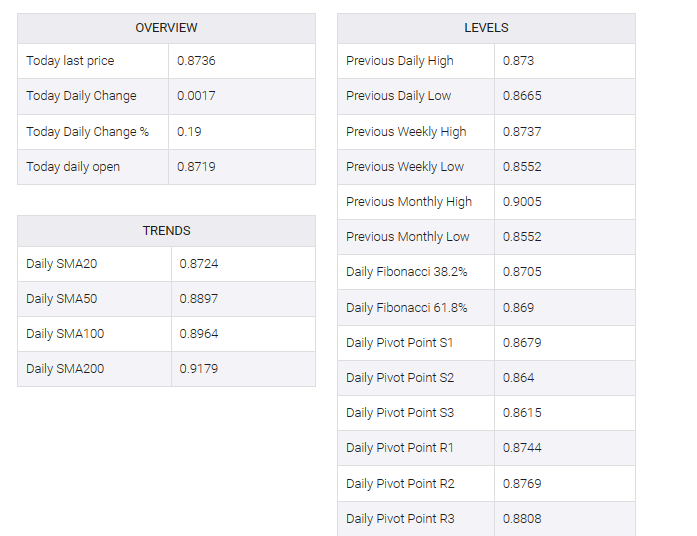

The USD/CHF pair offered an upside break of consolidation formed near 0.8700 in the London session. The Swiss Franc asset strength picks, following in the footsteps of the US Dollar Index (DXY). Fears of a global recession boost the appeal of the US dollar, making it a safe haven.

S&P500 futures posted some losses in Europe, reflecting caution among market participants heading into the Q2 corporate earnings season. US equities were flat on Monday as investors remained cautious ahead of labor market data released this week.

The US dollar index (DXY) extended its three-day winning streak as Federal Reserve (Fed) policymakers remained confident of further interest rate hikes amid tight labor market conditions. Chicago Fed President Austin Golsbee favors tightening policy even as inflationary pressures ease.

Meanwhile, investors await the United States manufacturing PMI to be reported by the Institute of Supply Management (ISM). According to estimates, US factory activity was higher at 46.5 in July but continued to settle at the contracting level. It is worth noting that a figure below 50.0 is considered contracted.

Swiss economy markets are closed on Tuesday for a national holiday, so investors will focus on the US economic calendar for guidance. Later this week, Swiss July Consumer Price Index (CPI) data will be in focus. As expected, monthly inflation rose 0.1%. An expansion of 0.1% was recorded for June. Annual inflation softened to 1.6% against the previous release of 1.7%.