-

USD/CHF rises to near 0.8450 major level as the Greenback gains ground.

-

US-Houthi clash in the Red Sea could reinforce the demand for the Safe-haven Swiss Franc.

-

Traders are expected to adopt caution as recent US data indicated the slowing of the US economy.

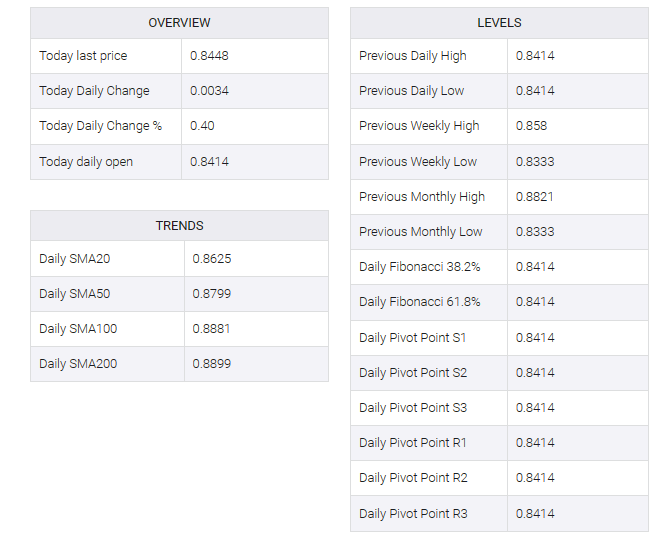

USD/CHF recovered its recent losses registered on Friday, trading near 0.8450 in the Asian session on Tuesday. The US Dollar (USD) found upside support at the start of the year, with the US Dollar Index (DXY) above 101.50.

Given the recent decline in US labor data, core PCE inflation and annual GDP, market participants may be cautious before bidding on the US dollar (USD). These indicators support the idea that the US economy is slowing in the fourth quarter, possibly heading for a soft landing. This reinforces the rationale for a Federal Reserve (Fed) rate cut in 2024, exerting negative pressure on the USD.

The Chicago Purchasing Managers’ Index released by ISM-Chicago on Friday showed business conditions in the Chicago area fell to 46.9 in December from 55.8 previously, beating market expectations for a 51.0 decline. ISM manufacturing PMI figures and meeting minutes from the Federal Open Market Committee (FOMC) are due to be released on Wednesday.

A naval conflict in the Red Sea could lead to higher risk aversion, which could increase demand for the safe-haven Swiss franc (CHF). Houthi militants attacked a Maersk container ship on Sunday, but US helicopters foiled the attack. After the incident, Iran sent a warship to the Red Sea. This situation raises the possibility of disruption of waterways vital for oil transport, including the Red Sea and the Strait of Hormuz in the Gulf.

Last week, the Swiss ZEW survey – expectations recorded a decline of 23.7 points in December compared to a decline of 29.6 in November. On a surprising note, the KOF Swiss Leading Indicator improved to 97.8, beating the expected reading of 97.0. Looking ahead, the SVME Manufacturing Purchasing Managers Index (PMI) is scheduled for release on Wednesday, adding to the economic indicators to watch.

The Swiss National Bank (SNB) appears poised to adopt a proactive stance, as indicated in its recent Quarterly Bulletin. The bank has conveyed its readiness to actively intervene in the foreign exchange market to provide support for the Swiss Franc (CHF).