-

The Dollar reaches fresh multi-year lows below 0.8550.

-

Weak US data is fuelling hopes of Fed cuts and weighing on the Greenback.

-

Later today, the US PCE Prices Index will provide further insight into the Fed’s policy outlook.

The US Dollar remains under strong bearish pressure against the Swiss Franc, hammered by the downward revision of the third quarter US Gross Domestic Product released on Thursday.

Weak US data fuels hopes of Fed cuts

The US economy grew at a 4.9% pace in Q3, below the previous estimate of 5.2% growth. At the same time, the Philadelphia Fed manufacturing survey revealed that sector firms deteriorated and US consumer spending fell in November, contrary to expectations.

These figures cement market expectations of a Fed deficit in early 2014 and confirm the soft landing view of US Treasury yields and sending the US dollar back to recent lows.

Against this backdrop, the market awaits the release of a batch of key US indices later today, with particular interest in the US PCE price index. A weaker-than-expected reading would strengthen the case for impending Fed cuts and increase negative pressure on the USD.

USD/CHF Technical analysis

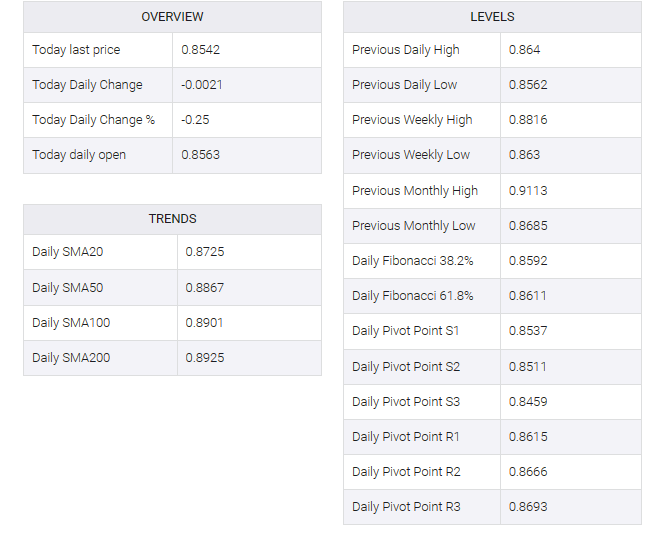

The USD´s bias is negative, confirmed by Thursday´s bullish engulfing candle and there is no clear sign of a trend shift in sight. The pair has pierced a long-term low at 0.8555 and might extend to 0.8500.

At those levels, RSI indexes would be at extremely oversold levels which allows for some correction. Resistances are at 0.8590 and 0.8635.