-

USD/CHF losses ground as the US Dollar turns into negative territory.

-

Downbeat US yields put pressure on the Greenback.

-

US CPI (YoY) is expected to ease to 3.1%, while monthly inflation to rise by 0.1%.

-

SNB could maintain rates at 1.75% on the eased Swiss inflation for November.

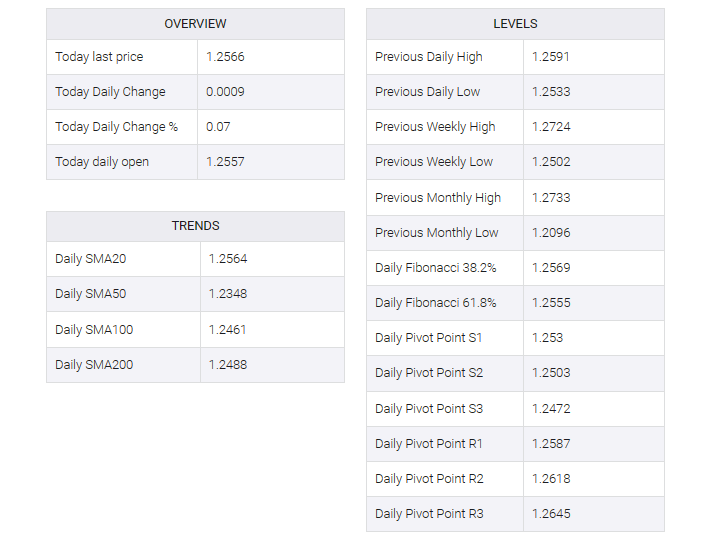

USD/CHF fell near 0.8770 during Asian trading hours on Tuesday, extending its losses for a second straight day ahead of US Consumer Price Index (CPI) data. The US Dollar Index (DXY) lost ground to lower US Treasury yields. The DXY slipped below 104.00, with 2-year and 10-year US bond coupon yields standing lower at 4.70% and 4.21%, respectively, as of press time.

Markets expect the annual US Consumer Price Index (CPI) to ease to 3.1% from 3.2% previously, with the monthly inflation figure expected to increase by 0.1%. US core CPI is expected to hold steady at 4.0%. Additionally, markets factored in expectations that the Federal Open Market Committee (FOMC) would keep rates between 5.25%–5.50%, according to the CME FedWatch tool. Additionally, markets expect a 25 basis point (bps) rate cut by March 2024.

The Swiss National Bank (SNB) is expected to keep policy rates at an unchanged level of 1.75% on Thursday, especially after the Swiss Consumer Price Index (YoY) for November eased to 1.4% from 1.7% previously.

The SNB will also communicate monetary policy assessments published in quarterly bulletins, which will provide insight into medium-term conditional inflation forecasts. Investors will also pay close attention to Swiss National Bank chief Thomas J. Jordan’s speech, as his comments could significantly impact the value of the Swiss franc (CHF).