-

USD/CHF drops vertically to near 0.9000 as the US Dollar remains soft.

-

Investors expect that the impact of the Israel-Hamas conflict would be lower if more players do not intervene.

-

The US PPI report remained hotter than anticipated due to higher gasoline and food prices.

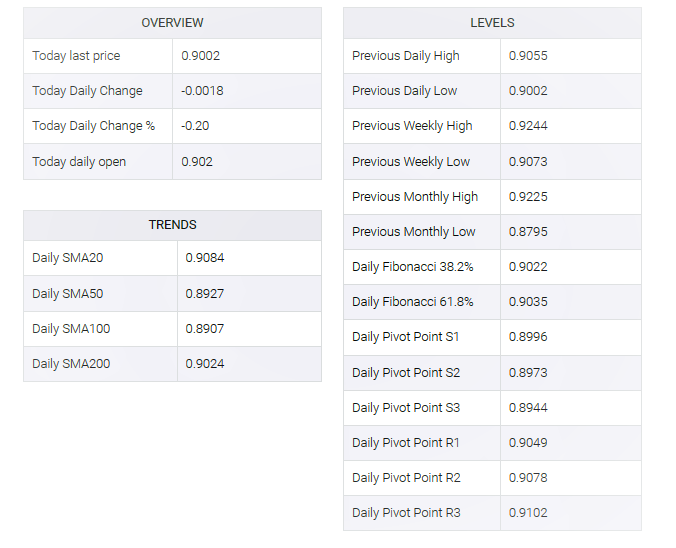

The USD/CHF pair continued its six-day losing streak and fell near the psychological support of 0.9000. A steep sell-off in Swiss franc assets came as the US dollar softened as investors expected the Federal Reserve (Fed) to keep interest rates unchanged in November. This will buy some time to assess the impact of the interest rate hike until it is done.

S&P500 futures added some modest gains in the London session, reflecting buoyant market sentiment as dovish Fed bets faded. Also, investors hope that the Israel-Hamas conflict will have less impact if more players do not intervene. In addition, Israel is not an oil-rich country, so the effect on oil prices may be limited.

Alongside the correction in the US dollar, the 10-year US Treasury yield also fell from a multi-year high to around 4.56%. Investors should brace for a volatile move in the US dollar as US inflation data is released at 12:30 GMT. September’s producer price index (PPI) report, released on Wednesday, was hotter than expected due to higher gasoline and food prices while prices of key goods and services fell at the factory gate.

Regarding US consumer price inflation, investors forecast that headline and core inflation rose 0.3% on a monthly basis in September. The annual core Consumer Price Index (CPI) fell to 4.1% from 4.3% earlier. The US CPI report for September will shape monetary policy decisions for the November meeting.

On the Swiss Franc front, investors await Producer and Import Prices, which will be published on Friday. The economic data could provide fresh impetus to the inflation outlook in the nation.