-

The USD/CHF rises to a daily high of 0.9000, above the 20-day SMA, then retreats towards the 0.8960 area.

-

Soft Swiss inflation figures from June weakened the Swiss Franc during the European session.

-

US Manufacturing PMI dropped to 46 in June, weighing on the US Dollar.

At the start of the week, the USD/CHF saw some volatility but remained in positive territory. Soft inflation figures from Switzerland weakened the Swiss Franc leading USD/CHF to rise initially while falling Treasury yields made the USD lose interest following a soft Manufacturing Purchasing Managers Index (PMI) release. The pair remains in positive territory, however, but has erased its daily gains which had seen the pair jump to a high of 0.9000 during the European session.

US yields fall after weak US Manufacturing PMI

The latest release from the Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) for June showed a reading of 46, below the expected 47.2 and the previous figure of 46.9.

Despite retreating US yields across the board, the Federal Reserve’s (Fed) expectations for July remain hawkish. According to the CME FedWatch tool, a 25 basis point (bps) hike is almost set for the next meeting on July 31, while the odds of another 25 bps increase in 2023 have increased to about 40%. Also, markets await Friday’s non-farm payrolls (NFP) data, which will continue to model expectations for the next Fed decision.

On the other hand, Switzerland’s Consumer Price Index (CPI) fell to 1.7% in June, down from 2.2% in May and below forecasts of 1.8%. The drop brought Swiss CPI back to the Swiss National Bank’s (SNB) target range of 0% to 2%, the first time it has come within this range since January 2022. In that sense, the SNB seems to have dovish bets that the CHF weakens, but the market still discounts at least one increase this year.

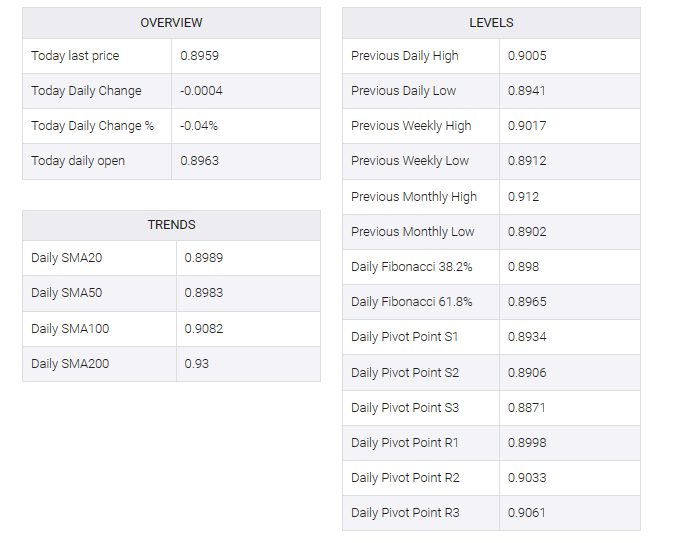

USD/CHF Levels to watch

According to the daily chart, the technical outlook still favours the CHF despite daily losses. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) still hold in negative territory. In addition, the pair trades below the 20, 100 and 200-day Simple Moving Averages (SMA), suggesting that the sellers are in control.

Resistance Levels to watch: 0.8978 (20-day SMA), 0.9000, 0.9050.

Support Levels to watch: 0.8940, 0.8915,0.8900.