-

USD/CHF extends its gains on the upbeat Greenback.

-

Swiss Survey Expectations declined from 27.6 to 37.8 in October.

-

US Dollar extends gains after robust US PMI data.

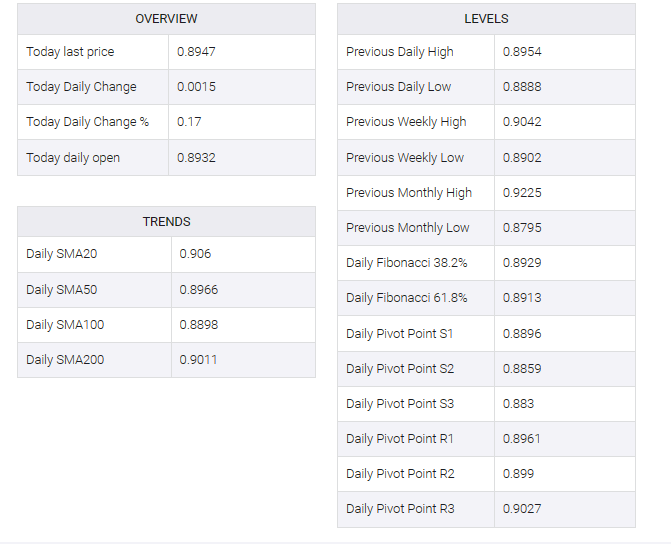

USD/CHF extended its gains for a second day in a row, trading near 0.8950 in the early European session on Wednesday. The pair strengthened, driven by positive purchasing managers’ index (PMI) data from the US, which provided support to the US dollar (USD).

The Swiss Franc (CHF) could be in for a bumpy ride with that ZEW survey. Expectations recorded a decline from 27.6 to 37.8 in October. This decline indicates a deterioration in business conditions and the labor market in Switzerland.

While the CHF, a safe-haven currency, may have found initial support amid geopolitical tensions between Israel and Hamas, diplomatic efforts to ease these tensions have contributed to a reduction in the market’s risk aversion. This has resulted in increased risk appetite of investors.

The US dollar index (DXY) made a comeback from its monthly lows, steadying around 106.30 at the time of writing, driven by positive preliminary S&P global PMI figures released on Tuesday.

Nevertheless, the decline in US Treasury yields for the 10-year yield to 4.82% by press time, could exert downward pressure on the US dollar (USD).

In October, the US S&P Global Composite PMI showed growth, climbing to 51.0 from 50.2. The services PMI saw improvement, reaching 50.9, while the manufacturing PMI rose to 50.0. It marked the first time in six months that manufacturing remained at or above the 50-point threshold, indicating a positive shift in that sector.

Investors are gearing up to closely monitor the US Q3 Gross Domestic Product (GDP) on Thursday, with additional attention on the US Core Personal Consumption Expenditures (PCE) data set for Friday.