-

USD/CHF drops as US core PCE rose by 4.6% YoY, below the previous month.

-

The University of Michigan’s Consumer Sentiment was below expected.

-

USD/CHF Price Analysis: Pushes towards 0.9100, but sellers struggle to break that support below.

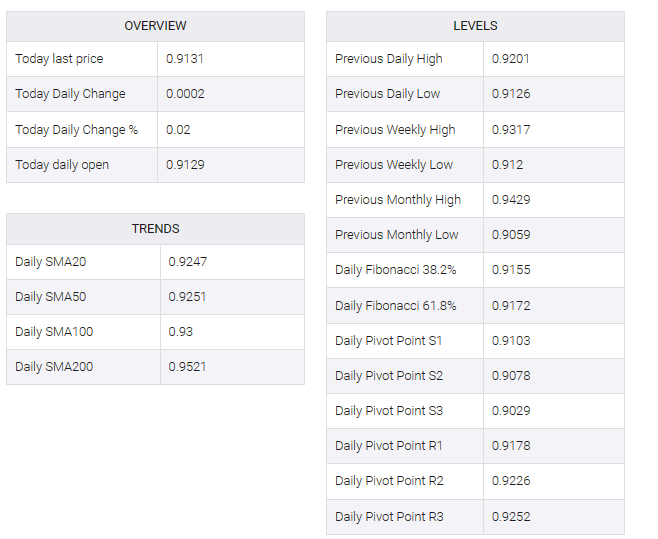

USD/CHF falls to a new weekly low below 0.9126, sponsored by economic data from the United States (US) showing that inflation is cooling down. Hence, bets that the US Federal Reserve (Fed) might pause its tightening cycle, increasing, meaning the greenback would be under pressure. At the time of writing, the USD/CHF is trading at 0.9127, below its opening price.

US core PCE edges lower, cementing the case for a Fed’s pause

The Federal Reserve’s preferred measure of inflation, core personal consumption expenditures (PCE), rose 4.6% YoY, down from 4.7% the previous month. On a monthly basis, inflation excluding food and energy rose 0.3%, below estimates of 0.4%.

Lately, the University of Michigan (UoM) consumer sentiment estimate was below 67 and came in at 62. According to survey director Joan Hsu, “Overall, our data revealed multiple signs that consumers are increasingly anticipating a recession ahead. ” The same survey found that inflation expectations for one year stood at 3.6%, down from 3.8%, while for a 5-year horizon, consumers estimated inflation at 2.9%.

USD/CHF extended its losses amid positive news on the US front. While Boston Fed President Susan Collins welcomed the data, she said it did not change her view, adding that the Fed had more work to do.

On the Switzerland front, the Swiss National Bank (SNB) continued to tighten monetary conditions when it hiked rates by 50 bps to the 1.50% area on March 23. Furthermore, retail sales rose 0.3% in February from a year earlier, giving the USD/CHF pair a leg-down.

USD/CHF Technical analysis

Even though the USD/CHF continued to press towards the 0.9100 figure, the sellers could not register a decisive break below the latter. Technical indicators like the Relative Strength Index (RSI) and the Rate of Change (RoC) are flat, suggesting that sellers are jumping from the boat. However, if the USD/CHF dives below 0.9100, that would open the door to challenge the YTD low at 0.9059. On the flip side, buyers reclaiming 0.9150 could pave the way for a recovery to 0.9200 and beyond.