-

USD/CHF remains depressed near its lowest level since early February touched on Monday.

-

Rebounding US bond yields revives the USD demand and limits the downside for the major.

-

Traders also seem reluctant and prefer to wait for the release of the crucial US CPI report.

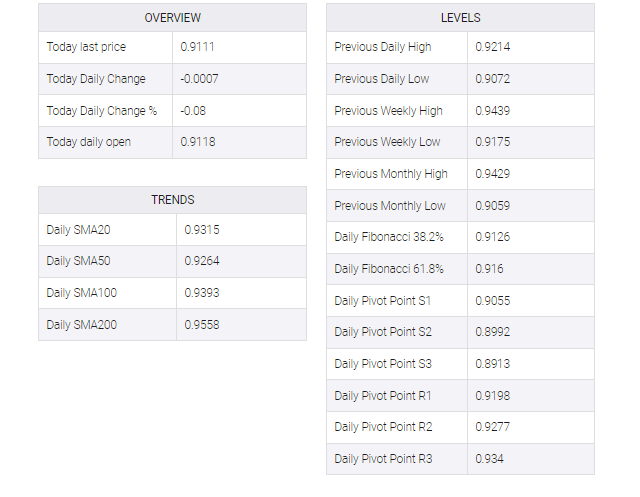

The USD/CHF pair attracts fresh selling following an early uptick to the 0.9145 region on Tuesday and remains on the defensive through the mid-European session on Tuesday. The pair is currently placed around the 0.9100 mark, down over 0.10% for the day and well within the striking distance of its lowest level since early February touched on Monday.

The downside for the USD/CHF pair, at least for now, appears to be bolstered by a good pickup in US Treasury bond yields, amid resurgent US dollar (USD) demand. The rise in US bond yields comes amid easing fears of a wider systemic crisis, particularly after US authorities moved to limit the fallout from the sudden collapse of Silicon Valley Bank (SVB). In addition to this, the recovery in global risk sentiment – as illustrated by a positive tone around equity markets – undermined the safe-haven Swiss franc (CHF) and became another reason to lend some support to the major.

Traders also seem reluctant to make aggressive bets and prefer to wait on the sidelines before the release of the latest US consumer inflation figures later in the North American session. Important US CPI data will play an important role in influencing near-term USD price dynamics in the USD/CHF pair ahead of the two-day FOMC policy meeting starting next Tuesday. In the meantime, expectations that the Fed will slow, if not stop, its interest rate-hiking cycle given the pressure on the US banking system could put a lid on US bond yields and prevent US dollar bulls from keeping aggressive bets.

The aforementioned fundamental backdrop suggests that the path of least resistance for the USD/CHF pair is to the downside. Bearish traders, however, are likely to wait for acceptance below the 0.9100 mark before placing fresh bets and positioning for an extension of the recent sharp pullback from the 0.9435-0.9440 supply zone, or the YTD peak touched last week.