-

The USD/CHF is grinding higher to eke out a second daily high, but momentum remains thin.

-

The US Dollar remains steeply sold-off against the Swiss Franc.

-

Economic calendar data leans heavily into the US side this week, culminating in another NFP print.

USD/CHF is rising for a second trading day, above 3, with the US dollar (USD) buoyed by broad-market risk-off flows rather than any specific weakness in the Swiss franc (CHF). % against the USD since the beginning of November

USD/CHF saw a one-sided trade, closing flat or in the red for fifteen consecutive trading days before hitting a near-term bottom of 0.8666. With Tuesday seeing negligible gains for the US dollar, USD/CHF is set to close with back-to-back meaningful gains since October.

The US JOLTS jobs market in October missed market forecasts, falling to a two-and-a-half-year low of 8.733 million job postings, beating forecasts of 9.3 million, and falling further from September’s 9.35 million (revised down) print of 9.553 million).

The US labor market remains tight, making it difficult for the Federal Reserve (Fed) to accelerate toward a rate-cutting cycle, and investors are skimming market data in hopes of finding a crack in the dataset that would signal a Fed rate cut. Shubasya rather later.

As it stands, markets expect the Fed to cut rates in the first half of next year, although still-high economic indicators make it difficult for the Fed to meet market expectations. On the downside, investors are walking a knife’s edge when it comes to data expectations: If US economic data turns too red, too quickly, a full-blown recession would be dire for markets.

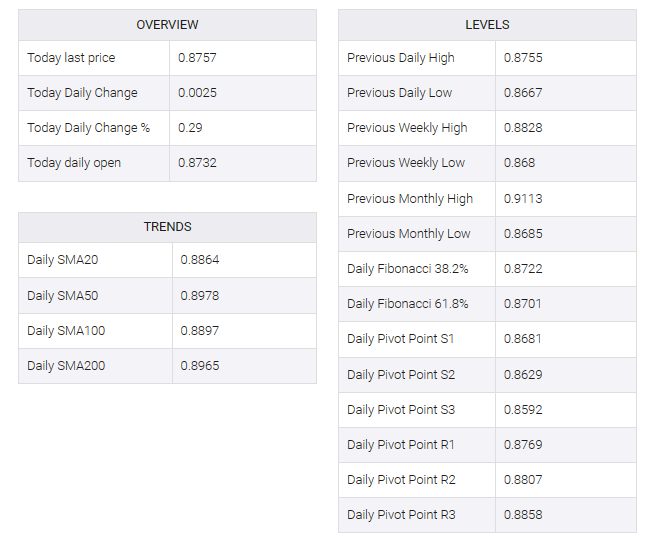

USD/CHF Technical Outlook

The USD/CHF remains steeply in the red in the medium-term despite intraday gains this week, and the US Dollar is down against the Swiss Franc looking out across 2023.

The USD/CHF saw an accelerated decline after dropping through in 0.8900 handle in November, and the pair has continued to swirl the drain ever since, shedding another 200 pips to hit chart territory near the 0.8700 handle.

The 200-day Simple Moving Average (SMA) has steadily declined through the 0.9000 major handle as long-term momentum leans into the Dollar-bearish side. The 50-day SMA is set for a bearish crossover of the 200-day SMA after the shorter moving average failed to see a bullish market shift materialize after a short-lived bullish crossover in November.