-

USD/CHF moves sideways near the psychological level ahead of US inflation.

-

Fed is expected to maintain interest rates at 5.5% during the policy meeting on Wednesday.

-

Market expects the Fed to keep monetary policy tightened for a longer period as the labor market showed resistance.

-

SNB is predicted to maintain policy rates at 1.75% in its upcoming meeting on Thursday.

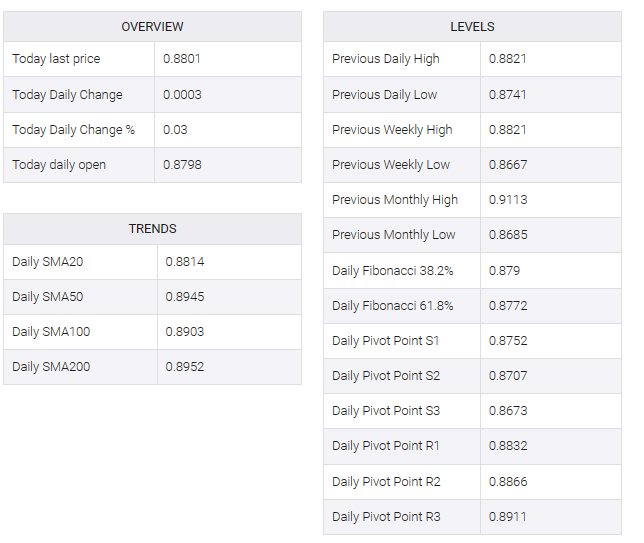

USD/CHF hovered around 0.8800 in Asian trading hours on Monday, struggling to extend its gains for the third session in a row. The USD/CHF pair is on an upward trajectory, driven by positive employment data from the United States (US). A rise in US bond yields, driven by speculation about the Federal Reserve’s (Fed) rate path, is strengthening the US dollar (USD) and providing support to the USD/CHF pair.

US non-farm payrolls for November beat expectations with a sharp rise of 199,000 and the unemployment rate fell to 3.7% from 3.9% previously. Additionally, the preliminary Michigan Consumer Sentiment Index for December showed a significant increase, reaching 69.4, a significant increase from the previous reading of 61.3.

However, the consensus is that the Federal Reserve (Fed) will keep interest rates at 5.5% during the upcoming monetary policy meeting on Wednesday. However, firm labor market conditions could put pressure on the Fed to maintain higher interest rates for longer. Investors are expected to closely scrutinize US Consumer Price Index (CPI) data on Tuesday, anticipating possible market implications.

On the Swiss front, the CHF experienced downward pressure following the release of seasonally adjusted Unemployment Rate data by the State Secretariat for Economic Affairs (SECO) last week. The report revealed that the total number of unemployed civilian laborers in November remained steady at 2.1%, consistent with previous figures.

Furthermore, the easing of the Swiss Consumer Price Index (YoY) for November at 1.4%, compared to the prior 1.7%, contributed to the depreciation of the Swiss Franc (CHF). The upcoming interest rate decision by the Swiss National Bank (SNB) on Thursday is expected to see the central bank maintaining policy rates at the unchanged level of 1.75%.