-

USD/CHF lacks bullish bias within a trend-widening formation during four-day uptrend.

-

RSI, MACD conditions suggest Swiss Franc buyer’s return.

-

200-SMA, multi-day-old descending resistance line add to the upside filters.

-

Sellers may have to retreat from 0.8550-45 even as bearish megaphone favors downside bias.

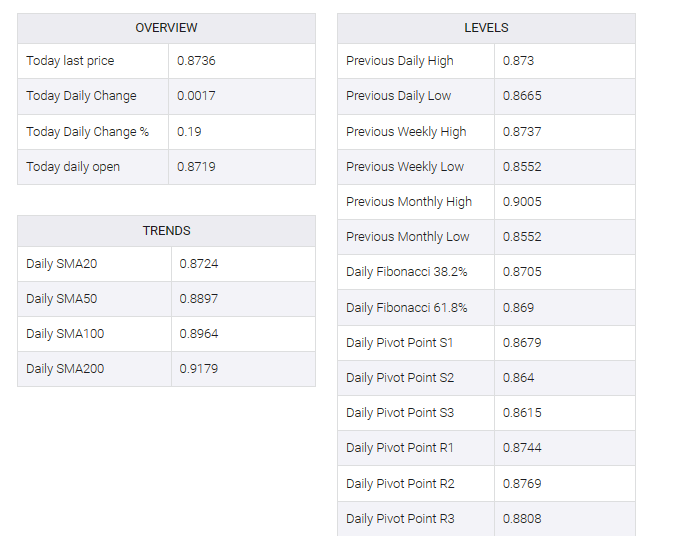

USD/CHF remains near 0.8720 as bulls struggle to hold the reins after a three-day winning streak. In doing so, the Swiss franc (CHF) pair retreated into a trend-winding formation called the “bearish megaphone” heading into Tuesday’s European session.

In addition to the bearish megaphone, the near overbought RSI (14) line and the impending bear cross on the MACD also prompt USD/CHF bulls after a three-day uptrend.

It is worth noting that the 0.8700 round figure and the one-week-old horizontal support near 0.8660-55 limit the Swiss franc pair’s short-term downside within a trend-broadening chart pattern.

After that, a sharp decline towards the 0.8630 and 0.8600 round figures is imminent before the megaphone bottom line, challenging the pair sellers near 0.8550-45.

On the upside, the top line of the aforementioned chart formation challenges the immediate upside of the USD/CHF pair around 0.8760.

Even if the quote defies a trend-broadening formation by crossing the 0.8760 barrier, the 200-SMA from May 31 and a downward-sloping resistance line, near 0.8815 and 0.8885, respectively, as well as the 0.8900 round figure, the USDF challenges bulls.

If at all the USD/CHF buyers keep the reins past 0.8900, their dominance will knock the 0.9000 psychological magnet.

USD/CHF: Four-hour chart

Trend: Limited downside expected