-

USD/CHF is making efforts for recovery after defending the critical support of 0.8960.

-

S&P500 futures have shown nominal losses in Asia amid anxiety over earnings data.

-

Fed Bostic favored one more rate hike and then holding them above 5% for some time.

The USD/CHF pair is eyeing a recovery after forming a base near 0.8960 in the Asian session. The Swiss franc asset has been defending the aforementioned support for the past two trading sessions. An attempted recovery by the US Dollar Index (DXY) near 101.65 added some strength to Swiss franc assets.

S&P500 futures showed nominal losses amid concerns over earnings data in Asia, portraying a cautious market mood. The USD index recovered above 101.70 and is expected to move ahead amid deepening Federal Reserve (Fed) bets.

Atlanta Fed President Raphael Bostick said he favors raising interest rates one more time and then keeping them above 5% for a while to control inflation, according to a Bloomberg report.

For further guidance, investors await the release of the Fed’s Beige Book, which will report the current economic conditions of the 12 Fed districts.

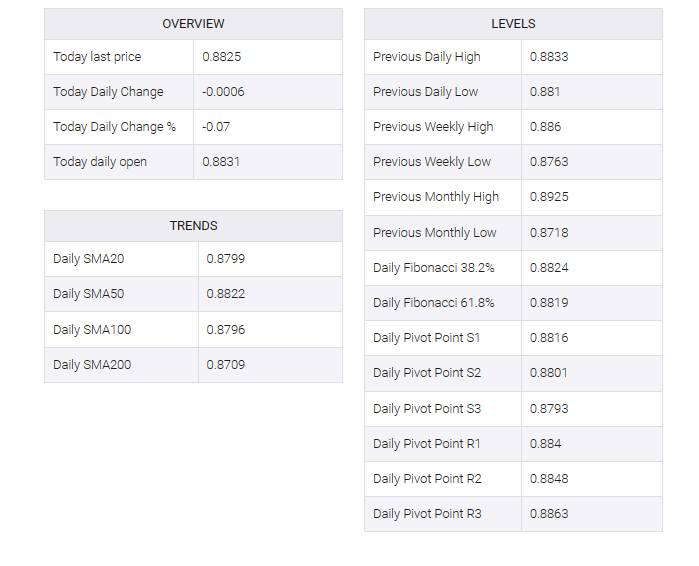

USD/CHF experienced a barricade near 0.9000 on the two-hour scale in a 23.6% Fibonacci retracement (from a high of 0.9439 as of March 08 to a low of 0.8860 as of April 13 placed at 0.8860). The Swiss franc asset’s recovery move will strengthen if it can rise above the 23.6% Fibo retracement.

The 20-and 50-period Exponential Moving Averages (EMAs) are on the verge of delivering a bullish crossover around 0.8966.

Meanwhile, the Relative Strength Index (RSI) (14) is making efforts for shifting its oscillation in the bullish range of 60.00-80.00.

Should the asset decisively breaks above the 23.6% Fibo retracement around 0.9000, US Dollar bulls will drive the asset towards April 07 low at 0.9034 followed by 38.6% Fibo retracement plotted at 0.9082.

Alternatively, a downside move below April 17 low at 0.8922 will drag the asset toward April 13 low at 0.8860. A slippage below the latter will expose the asset to the round-level support at 0.8800.