-

USD/CHF takes bid to refresh intraday bottom, fades to nine-month low.

-

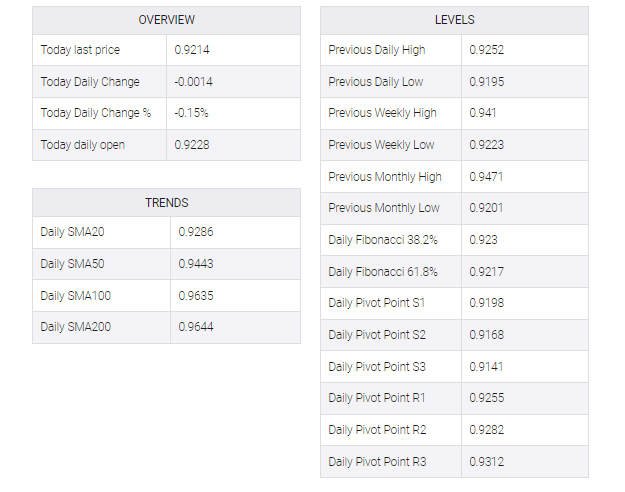

Downside break of weekly support line, bear cross underpin downside bias.

-

Recovery moves remain elusive unless crossing 0.9275 hurdle.

USD/CHF breaks an upward-sloping trend line to welcome bears after the previous day’s brief absence. That said, the Swiss Franc (CHF) pair renews its intraday low around 0.9210 during the early hours of Wednesday morning in Europe.

In addition to the downside break of the two-day-old support line, USD/CHF also cheers bear cross of the key moving averages on the hourly format. The bearish moving average crossover could be witnessed as the 100-Hour Moving Average (HMA) slips beneath the 200-HMA.

It’s worth noting that an absence of oversold RSI also signals a smooth road to the south for the pair sellers.

As a result, the USD/CHF pair is all set to revisit the monthly low surrounding 0.9165, which is also the lowest level since March 2022.

In a case where the bears keep reins past 0.9165, the 0.9100 round figure and the previous yearly low around 0.9090 will gain the market’s attention.

On the contrary, the support-turned-resistance line stretched from Monday, around 0.9230 by the press time, guards immediate recovery of the USD/CHF pair.

Following that, a three-day-old trend line resistance near 0.9255 could test the pair buyers.

However, the USD/CHF bulls may remain cautious unless witnessing a clear upside break of the key HMA convergence surrounding 0.9275.

USD/CHF: Hourly chart

Trend: Further downside expected