-

USD/CHF remains a soft bid as buyers struggle to regain control after a two-day absence.

-

Descending trend line from Monday restricts guards immediate recovery ahead of 100, 50 HMAs.

-

Strong oscillators suggest further recovery action, 0.9330 is key resistance.

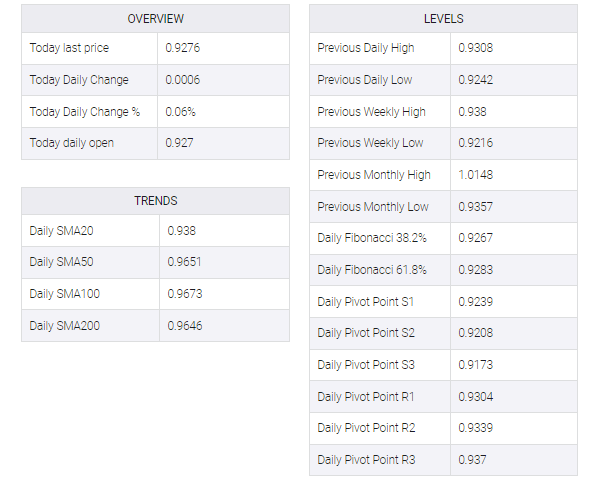

USD/CHF grinds higher around the intraday top of 0.9281 as buyers attack a three-day-old resistance line during early Wednesday. In doing so, the Swiss Franc pair prints the first daily gains since last Friday.

USD/CHF pair’s latest recovery gains support from the bullish MACD signals and gradually rising RSI (14). As a result, the pair is likely to overcome the immediate hurdle near 0.9280.

However, the 100-HMA and the 50-HMA could challenge further advances around 0.9290.

After that, the 0.9300 round figure and a downward sloping resistance line from December 12, near 0.9330, will be important to welcome USD/CHF buyers.

In that case, the quote could run towards the mid-month high before pointing the bulls towards the 0.9400 round figure around 0.9385.

Conversely, the previous day’s low near 0.9240 and the monthly low around 0.9215 could support the USD/CHF bears before highlighting the 0.9200 threshold.

It is worth noting that the downside of the pair before 0.9200 seems to be difficult as possible oversold RSI conditions at that point join the April 2022 low of 0.9195 to limit further declines.

If the USD/CHF drops below 0.9195, the yearly low of 0.9090 will be the focus of the bears.

USD/CHF: Hourly chart

Trend: Limited recovery expected