-

USD/CHF grinds higher in a monthly triangle, struggling to extend the two-day uptrend.

-

Sustained break of 10-DMA, bullish MACD signals keep buyers hopeful.

-

USD/CHF buyers lurk around six-week-old descending support line.

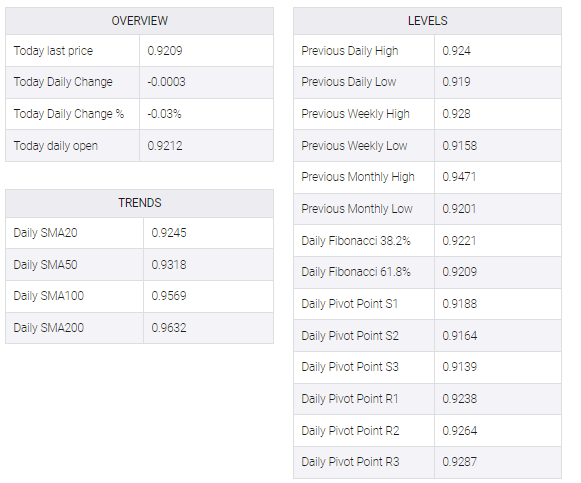

USD/CHF bulls take a breather around 0.9210 during Monday’s sluggish Asian session, following a two-day uptrend, as traders await this week’s bumper data/events. Also challenging the Swiss Franc (CHF) pair is the return of Chinese traders after a one-week-long Lunar New Year (LNY) holiday.

It’s worth noting that the quote marked the first daily closing beyond the 10-DMA since January 11 the previous day. That said, the upside break of the short-term key moving average joins the bullish MACD signals to suggest the USD/CHF pair’s further upside.

However, a symmetrical triangle formation connecting levels marked since January 06 restricts short-term USD/CHF moves between 0.9235 and 0.9170.

It should be noted that a downward-sloping support line from December 14, 2022, near 0.9125 by press time, acts as an additional filter to the north.

In a case where the USD/CHF bears dominate past 0.9125, the 0.9100 round figure and the monthly low of 0.9085 could act as the last defense of the buyer.

On the flip side, a successful break of the 0.9235 hurdle could propel the USD/CHF buyers toward the monthly peak surrounding 0.9410. It’s worth observing that the August 2022 low near 0.9370 acts as an extra filter towards the north.

USD/CHF: Daily chart

Trend: Further upside expected