-

USD/CHF delivers a lackluster performance ahead of Fed policy.

-

Higher US bond yields and gradually easing price pressures warrant a steady policy decision from the Fed.

-

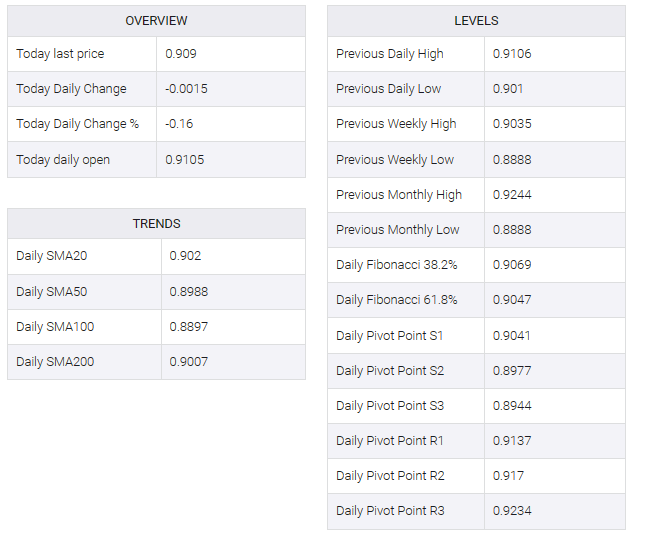

USD/CHF aims to stabilize above the horizontal resistance plotted from 0.9090.

The USD/CHF pair traded back and forth in a narrow range near the round-level resistance of 0.9100 in the late European session. Swiss franc assets are struggling for direction as investors await the Federal Reserve’s (Fed) monetary policy decision and key economic data from the United States.

The Fed is expected to deliver a neutral interest rate decision but will maintain a dovish guidance as inflation risks persist. High US long-term bond yields and gradually easing price pressures are supporting a steady monetary policy decision from the Fed.

Meanwhile, investors await Swiss National Bank (SNB) Governor Thomas J. Jordan’s remarks that will affect the outlook for the Swiss franc. The SNB is expected to discuss keeping interest rates longer to keep Jordanian inflation sustainably close to or below 2%.

USD/CHF’s target is 0.9090 fixed above the horizontal resistance plotted from September 29, which is turning into a support. The upward sloping 20-period exponential moving average (EMA) indicates that the near-term outlook is bullish. The Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, indicating strength in favor of the US dollar bulls.

A fresh upside would appear if the asset breaks above the round-number resistance of 0.9100, which will drive the asset toward May 31 high around 0.9147, followed by October 6 high at 0.9176.

On the contrary, a downside move below October 25 low at 0.8920 would expose the asset to October 24 low at 0.8888. Further breakdown below the latter would drag the asset toward September 5 low around 0.8830.