-

USD/CHF seesawed in a 100-pip range but finished Thursday’s session with losses of 0.44%.

-

USD/CHF bearish bias remains, but it needs to break below 0.9200 to challenge 0.9167 YTD.

-

It would turn bullish above the 20-day EMA nearby 0.9300.

After attempting to clear 0.9300, the USD/CHF resumed its downtrend due to the release of a softer inflation report in the United States (US), which spurred a repricing for a less aggressive Federal Reserve (Fed); consequently, the US Dollar weakened. Therefore, the USD/CHF erased its earlier gains and dived beneath 0.9280 as the Asian session began. At the time of writing, the USD/CHF is almost unchanged, around 0.9270.

USD/CHF Price Analysis: Technical outlook

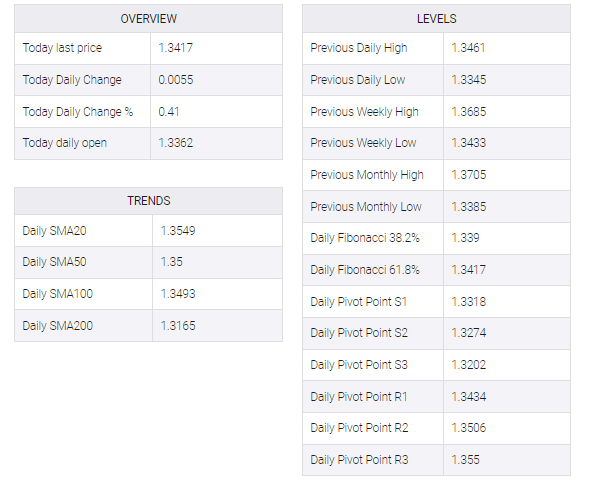

Following the US CPI release, USD/CHF traded in the 0.9265/0.9360 range before stabilizing near 0.9270, 30 pips below the 20-day exponential moving average (EMA) at 0.9294. Oscillators like the Relative Strength Index (RSI) are pointing downwards and the Rate of Change (RoC) is almost flat suggesting sellers are gathering momentum. However, to further extend its downtrend, USD/CHF bears should aim for the 0.9200 mark and support wall below 0.9265.

On the other hand, if USD/CHF buyers reclaim the 20-day EMA, that will immediately expose 0.9300, followed by the current week’s high of 0.9360, on its way north to 0.9400.