-

USD/CHF gains momentum around 0.9165, the highest since April.

-

The overbought RSI condition indicates that further consolidation cannot be ruled out.

-

A psychological round mark at 0.9200 is the first resistance level; 0.9128 acts as an initial support level.

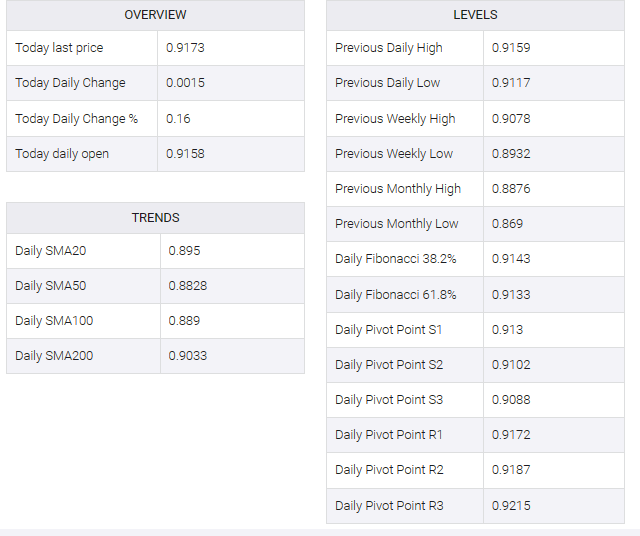

The USD/CHF pair held positive ground for seven consecutive days in the first European session on Wednesday. At the time of writing, USD/CHF was up 0.09% on the day at 0.9165. Market participants await the Swiss ZEW survey on Wednesday and the Swiss National Bank (SNB) quarterly bulletin for fresh stimulus ahead of Friday’s US consumer price index.

Technically, USD/CHF is above the 50- and 100-hour exponential moving averages (EMAs) with an upward slope on the four-hour chart. This indicates that the path of least resistance for the pair is upside down. The Relative Strength Index (RSI) holds above 50 in bullish territory. However, overbought RSI conditions indicate that further consolidation cannot be ruled out before positioning for any near-term USD/CHF valuations.

The first resistance level for USD/CHF is located at 0.9200, which represents a psychological round figure and the March 30 high. A break above the latter would see a rally to 0.9245 (March 22 high) on the way to 0.9300 (a high (March 17 and round figure).

Looking at the downside, a low of September 26 at 0.9128 acts as an initial support level for USD/CHF. Further south, the next stop is seen near the 50-hour EMA at 0.9053. Any intraday pullback below the latter would expose the next contention at 0.9035 (the lower limit of the Bollinger Band), followed by 0.8990 (the 100-hour EMA).