-

USD/CHF faces challenges as investors price in the Fed rate cuts.

-

MACD indicator suggests the subdued momentum in the pair.

-

A fall below the 0.8500 level could lead the pair to revisit the weekly low at 0.8460.

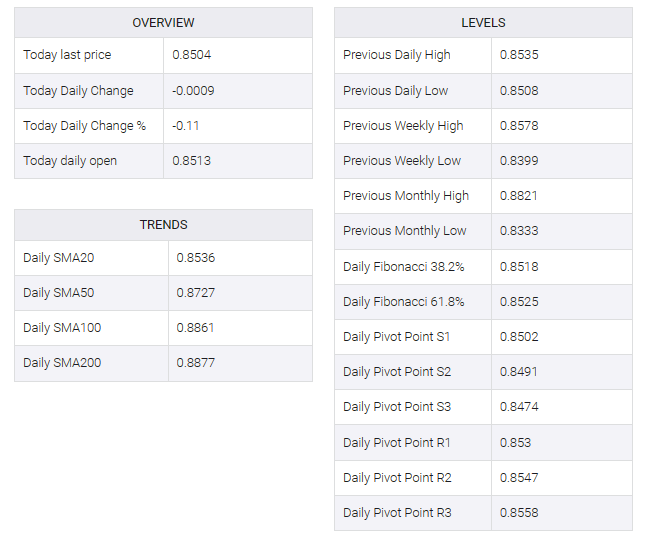

USD/CHF moves on a downward trajectory for the second successive day, trading near 0.8510 during the European hours on Thursday. The USD/CHF pair encounters difficulties as investors shift their focus away from the US Dollar (USD), possibly due to speculation about five interest rate cuts by the Federal Reserve (Fed) in 2024.

Technical indicators The 14-day Relative Strength Index (RSI) suggests a bearish market sentiment for the USD/CHF pair as it stands below 50. Moreover, the moving average convergence divergence (MACD) line, although positioned below the center line, is the signal line. This suggests a lower momentum in the EUR/USD pair. Market participants will likely remain cautious and wait for confirmation from lagging indicators.

The USD/CHF pair may break below the psychological support at 0.8500 and follow a key support level at the weekly lows of 0.8460 and 0.8450. A break below the latter could push the USD/CHF pair to navigate the region around the key level at 0.8400.

On the upside, the 23.6% Fibonacci retracement level at 0.8547 could act as an immediate resistance zone, aligned with the 21-exponential moving average (EMA) at 0.8549. A breakthrough above the zone could lead the USD/CHF pair to explore the psychological zone around the 0.8600 level.