-

US Dollar remains weaker, despite upbeat US Nonfarm Payrolls report.

-

USD/CHF hit daily highs following US NFP headlines but later dipped.

-

USD/CHF: Break below 0.9370 to pave the way to the 0.9300 figure.

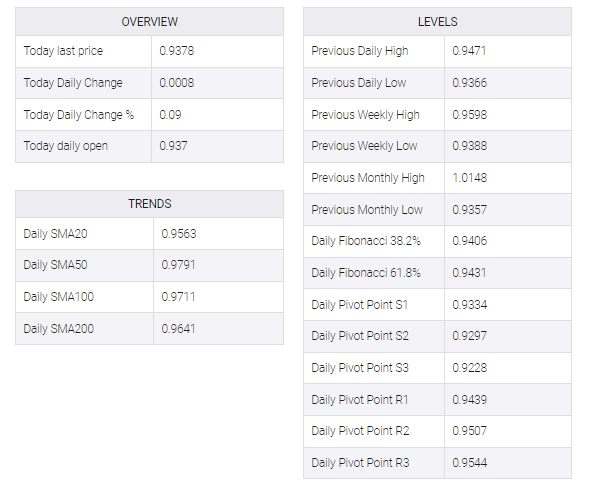

The USD/CHF trims some of its earlier losses/gains in a volatile trading session, spurred by a buoyant US Nonfarm Payrolls report for November, which increased the likelihood that the US Federal Reserve (Fed) will keep increasing borrowing costs. Nevertheless, manufacturing activity slowing reignited recession fears in the US economy. Therefore, the USD/CHF fluctuates around 0.9370s at the time of writing.

USD/CHF Price Analysis: Technical outlook

USD/CHF rallied to a daily high of 0.9439 in the Friday session after the NFP headline crossed the newswire. However, it was used by Swiss Franc (CHF) buyers to open new short positions in USD/CHF, as shown by its previous gains being erased, returning below the psychological 0.9400.

Oscillators such as the Relative Strength Index (RSI) are almost flat in bearish territory, suggesting consolidation ahead, while the 9-day Rate of Change (RoC) is in charge of sellers.

Therefore, the path of least resistance is downward biased. At the time of typing, the USD/CHF tests August 11 daily low of 0.9370, which, once cleared, could pave the way towards testing the fresh 7-month low of 0.9326, followed by the 0.9300 figure.