-

USD/CHF remains pressured near intraday low, prints the first daily loss in three.

-

Multiple support stands tall to challenge sellers even with bearish crosses on the MACD signal.

-

200-HMA, two-week-old descending trend line guard immediate upside.

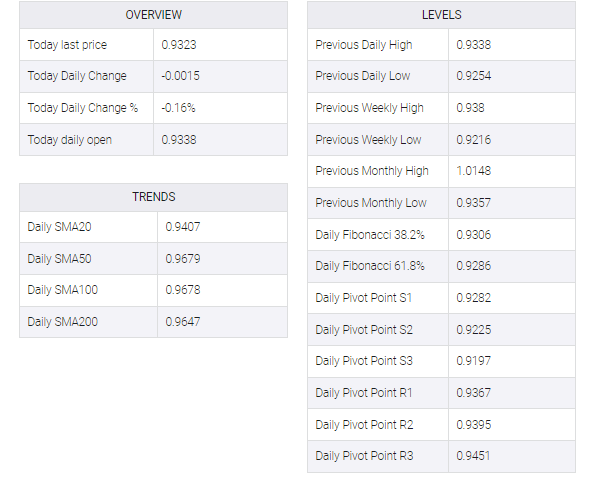

USD/CHF holds lower ground near the intraday bottom as bears struggle to retake control, after a two-day leave, during early Monday. That said, the Swiss Franc (CHF) pair prints mild losses near 0.9320 by the press time.

The quote’s latest weakness could be associated with a fortnight-long descending resistance line as well as a U-turn from the 200-HMA. Also keeping USD/CHF optimistic is the looming bear cross on the MACD indicator.

However, unless the quote breaks above the previous resistance line from November 30, downside moves remain implausible to the pair’s bears until close to the 0.9300 threshold by press time.

Also challenging the USD/CHF bulls is an upward-sloping trend line from the last Wednesday, around 0.9280 at the latest.

In a case where the quote remains bearish below 0.9280, the odds of witnessing a downturn toward the monthly low near 0.9215 can’t be ruled out.

On the flip side, buyers need to keep the reins past 0.9350 to mark their dominance. In doing so, the quote should stay past the aforementioned immediate resistance line and the 200-HMA.

Following that, a run-up towards the 0.9400 threshold and then to the monthly high 0.9470 can’t be ruled out.

USD/CHF: Hourly chart

Trend: Further weakness expected