-

USD/CHF advances above 0.8500 amid a sharp recovery in the US Dollar.

-

Investors’ risk-appetite trims ahead of the FOMC minutes.

-

USD/CHF aims stabilization above 0.8500 for further upside.

The USD/CHF pair provided a decisive break above the psychological resistance of 0.8500 in the European session. Swiss franc assets extended their recovery near 0.8520 amid a sharp rebound by the US dollar index (DXY) and manufacturing PMI data for December by the Institute of Supply Management (ISM) ahead of the Federal Open Market Committee (FOMC) minutes. .

Market sentiment turned risk-averse amid warnings that the absence of interest rate cut talks from policymakers in December’s monetary policy FOMC minutes could undermine the recent recovery in risk-sensitive assets.

For the ISM Manufacturing PMI, investors see a nominal rebound to 47.1. The previous reading was 46.7. Economic data is expected to remain below the 50.0 threshold in the 14th month.

On the Swiss franc front, the December manufacturing PMI rose to 43.0 versus the previous reading of 42.1.

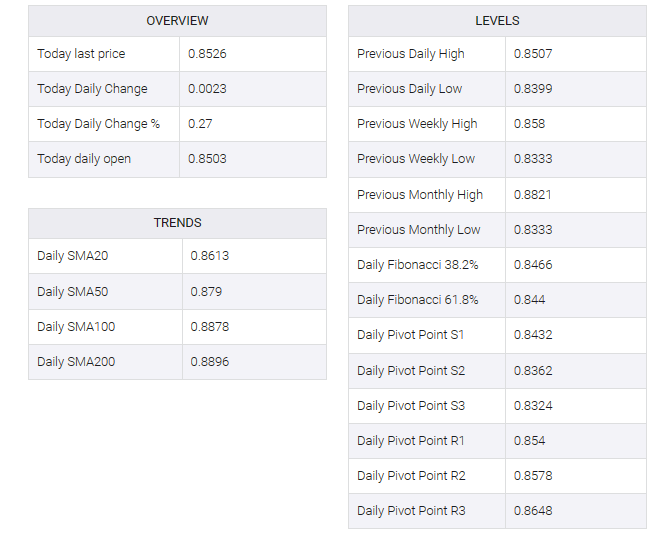

USD/CHF advanced sharply after providing a breakout of consolidation formed in a narrow range around 0.8500. The Swiss franc asset rose above the horizontal resistance plotted from 22 December 2023 at 0.8514. Stability on top of that will strengthen US dollar bulls.

The upward sloping 50-period exponential moving average (EMA) indicates the strength of the near-term trend.

The Relative Strength Index (RSI) (14) oscillates in a bullish range of 60.00-80.00, indicating strength in upside momentum.

Further upside above December 26 high near 0.8580 would drive the asset towards the round-level resistance of 0.8600, followed by December 21 high at 0.8633.

On the contrary, a downside move below December 28 high around 0.8450 would drag the asset towards the round-level support of 0.8400 and December 29 low of 0.8357.