-

USD/CHF stays pressured after reversing from one-week high the previous day.

-

Failure to cross 100-EMA, easing bullish bias of MACD lures Swiss Franc buyers inside bearish megaphone formation.

-

Two-month-old previous resistance line lures intraday sellers; bulls need 200-EMA breakout to convince markets.

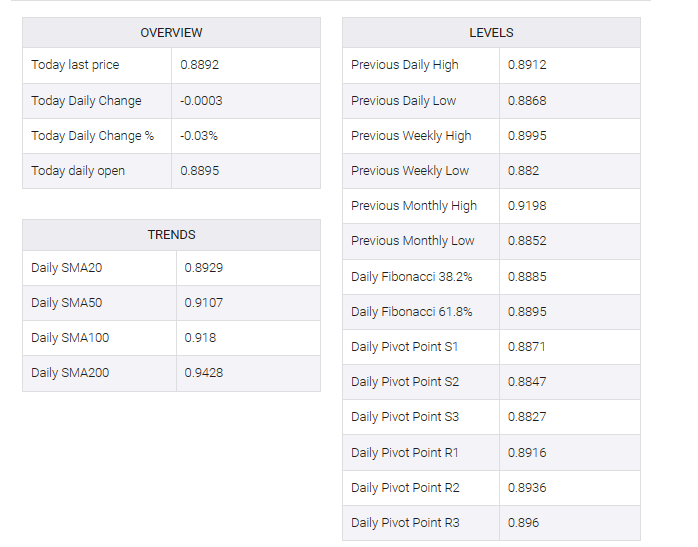

USD/CHF remains bearish below 0.8900 for the second day in a row, as it retreated from the 200-EMA barrier in Tuesday’s European session.

In addition to taking a U-turn from the 200-Exponential Moving Average (EMA), sellers are optimistic that USD/CHF also maintains the pair’s sustained trading within the easy bullish bias of the MACD and the three-week-old bearish megaphone trend-winding chart pattern.

That said, the Swiss Franc (CHF) pair bears may initially aim for the previous resistance line from March 08, now immediate support near 0.8840.

After that, the bottom line of the aforementioned megaphone, last around 0.8810, quickly followed by the 0.8800 round figure, could test the USD/CHF bear.

On the other hand, the USD/CHF pair’s rebound may challenge the 100-EMA barrier near 0.8930.

In a case where Swiss Franc (CHF) sellers manage to hold the reins above 0.8930, the top line of the aforementioned megaphone and the 200-EMA, around the 0.8980 and 0.9000 round figures respectively, could act as the last defense for USD/CHF bears.

If USD/CHF buyers manage to hold the line after 0.9000, the mid-March low and the previous monthly high, near 0.9070 and 0.9200 respectively, should get their attention.

Overall, USD/CHF is likely to remain pressured but the downside room appears limited.

USD/CHF: Four-hour chart

Trend: Further downside expected