-

The USD/CHF downfall stalled around 0.9200 as a triple bottom emerged.

-

A falling wedge and oscillator flashing selling pressure could pave the way for further upside in USD/CHF.

-

USD/CHF is poised for a break above 0.9300 as it eyes a test of the 20-day EMA.

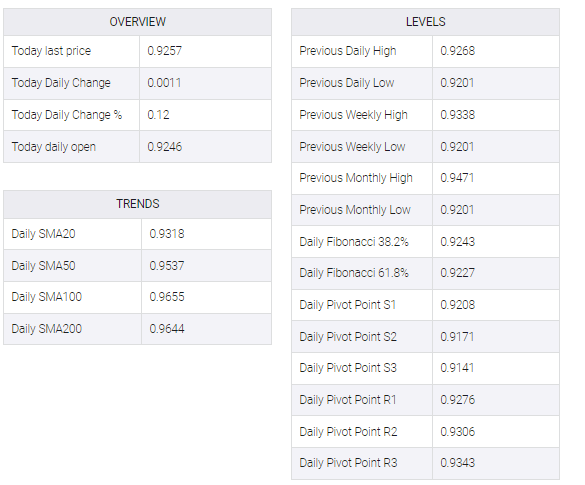

The Swiss Franc (CHF) bounces at around 0.9200 and climbs toward 0.9250s amidst the North American session, which witnessed light liquidity conditions in the observance of 2023 new year’s eve. Therefore, the lack of US and Swiss economic data left traders adrift to market mood and technical. At the time of writing, the USD/CHF is trading at 0.9255, above its opening price by 0.15%.

USD/CHF Price Analysis: Technical outlook

The daily chart shows the pair as bearish biased, but it also appears to have broken down around 0.9200. Since December, the inability of the USD/CHF pair to break below 0.9200, forming a triple bottom, has opened the door for a leg-up, although the low liquidity conditions since last week have prevented the USD/CHF pair from testing the 0.9300 figure. The Relative Strength Index (RSI) remains in bearish territory, limiting any rally towards 0.9300, while the Rate of Change (RoC) shows that selling pressure is waning.

Also, the USD/CHF is forming a falling wedge that it’s bullish. Therefore, the USD/CHF might test the 0/9300 figure, closely followed by a challenge of the 20-day Exponential Moving Average (EMA) at around 0.9319. The break above will expose the top-trendline of a descending channel around 0.9370, followed by the 0.9400 figure.