-

USD/CHF bids to reverse early day rebound, fade bounce to eight-day low.

-

SNB stays ready for more rate hikes after 0.50% lift, as expected.

-

Fed bets struggle to regain hawkish bias amid banking sector debacle.

-

US statistics may offer an active day ahead, yields eyed too.

USD/CHF renewed its intraday low near 0.9160 as it snapped a four-day losing streak early Friday ahead of key US data. In doing so, the Swiss franc (CHF) pair justified the hawkish bias surrounding dovish bets amid a sluggish end to a volatile week on the Swiss National Bank (SNB) versus the Federal Reserve’s (Fed) next move.

The SNB raised its benchmark sight deposit interest rate by 50 basis points (bps) in March from 1.0% to 1.50%, as widely expected. With the SNB raising rates for the fourth consecutive meeting, markets now expect a final hike in June

After the interest rate announcement, SNB Chairman Thomas Jordan said further rate hikes could not be ruled out to ensure price stability. The policymaker also said it would be irresponsible to risk a Credit Suisse bankruptcy, while adding, “The steps taken by the federal government, FINMA and the SNB stopped the crisis.”

Andrea Mechler, a member of the SNB Governing Board, also spoke on Thursday, saying, “Tensions in the financial markets increased significantly after the collapse of Silicon Valley Bank.”

Elsewhere, the Fed’s heavy debt amid banking woes raised fears of a ballooning Fed balance sheet, which in turn renewed hawkish calls for further action by the US central bank. However, mixed US data and the latest Fed statement seem to challenge policy hawks. The US dollar may also be challenged by comments from key market players such as DoubleLine’s Gundlach who recently reiterated his dovish bias for the US central bank.

It is worth noting that comments from US Treasury Secretary Janet Yellen and Basel Committee Chair on Banking Supervision also weigh on market sentiment and challenge the USD/CHF bear. But the pair’s sellers are optimistic as yields have fallen in recent times.

The Financial Times (FT) recently noted that the head of the world’s top financial regulator, Pablo Hernandez de Cos, has called for tougher rules to curb risks spilling over from so-called “shadow banks” into other parts of the banking system. . On the other hand, US Treasury Secretary Janet Yellen said on Thursday that “China and Russia may want to develop alternatives to the US dollar,” while also showing readiness for additional deposit measures ‘if needed’.

That said, the US Chicago Fed National Activity Index (CFNAI) fell to -0.19 in February vs. 0.0 expected and 0.23 earlier. Further, weekly initial jobless claims fell to 191K in the week ended March 18, versus 192K earlier and 203K market forecasts. It should be noted that US New Home Sales in February rose 1.1% from 1.8% earlier, versus analysts’ estimates of 1.6%, while the Kansas Fed Manufacturing Index for March rose 3.0 from -9.0 earlier and 6.0 was expected.

Against this backdrop, US 10-year and two-year Treasury bond yields hovered around 3.38% and 3.78% respectively by press time while S&P 500 futures struggled to copy Wall Street’s positive moves.

Looking ahead, US S&P Global PMIs for March and the first reading of February durable goods orders will be important for USD/CHF pair traders to watch for clear direction.

Also read: S&P Global PMIs preview: EU and US figures to shed light on economic progress

Technical analysis

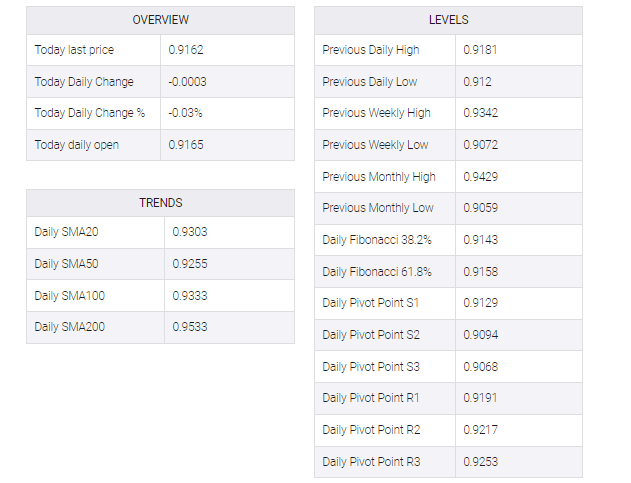

Oversold RSI (14) challenges USD/CHF bears approaching a seven-week-old ascending support line near 0.9130. Recovery moves, however, remain elusive unless the quote stays successfully beyond the 0.9200 threshold.