-

USD/CHF has lacked upside momentum of late, after its biggest gain in a week.

-

US Dollar cheers firmer data, hawkish Fed bets and US President Biden’s comments.

-

Headlines surrounding China, Russia flash mixed clues amid sluggish session.

-

US core PCE price index, durable goods orders will be important to rein in the bulls.

USD/CHF seesaws around intraday high as traders await fresh clues during early Friday. In doing so, the Swiss Franc (CHF) pair portrays the market’s cautious mood ahead of the key US data, despite defending the US Dollar’s strength. Also challenging the pair bulls could be the mixed macros and the year-end season that knocks on the door.

Optimism over China’s pro-growth policies gained momentum recently after the People’s Bank of China (PBOC) marked its biggest weekly cash injection in two months. It joins policymakers’ pledge to protect the world’s second-largest economy from overcoming Covid-induced pessimism with more stimulus. It’s worth noting that chatters around Everglade with offshore debt restructuring plans are also based on cautious optimism in the market.

On the other hand, Shanghai’s hospitalizations and challenges to China’s medical system seem to be probing optimists due to the latest easing of the zero-covid policy. Furthermore, the passage of a $1.7 trillion government funding bill in the US Senate and recent comments by US President Joe Biden showing readiness to rein in inflation keep USD/CHF buyers optimistic.

It should be noted that the hawkish Fed rate hike supported by Thursday’s US data is also based on USD/CHF. That said, the US economy expanded at an annualized rate of 3.2% in the third quarter (Q3), according to the final reading of gross domestic product (GDP), up from the previous estimate of 2.9%. Further, Personal Consumption Expenditure (PCE) prices matched Q3 2022 estimates at 4.3% QoQ while core PCE improved to 4.7% QoQ vs. 4.6% market forecast.

Amid these plays, S&P 500 Futures print mild gains while ignoring the Wall Street benchmarks. Further, the US 10-year Treasury bond yields extend the previous day’s rebound near the one-month high, marked early in the week.

Looking forward, USD/CHF traders may pay attention to the risk catalysts ahead of the US Core Personal Consumption Expenditure (PCE) – Price Index, the Federal Reserve’s preferred inflation gauge, as well as Durable Goods Orders, for November. As per the market consensus, the US Core PCE Price Index remains unchanged at 0.2% MoM. However, the Annualized forecasts suggest softer figures of 4.7% YoY versus 5.0% previous readings. Further, US Durable Goods Orders could register a contraction of 0.6% in November compared to the previous increase of 1.1% (revised from 1.0%). Given the mixed forecasts for the key data, as well as the recent improvement in sentiment, the USD/CHF buyers should remain cautious.

Technical analysis

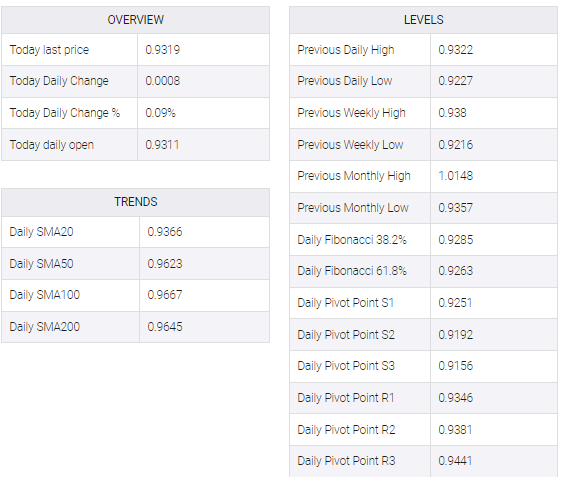

A daily closing break of the 13-day-old resistance line, now support around the 0.9300 threshold, keeps USD/CHF buyers hopeful of poking the monthly resistance line, around 0.9400 by the press time.