-

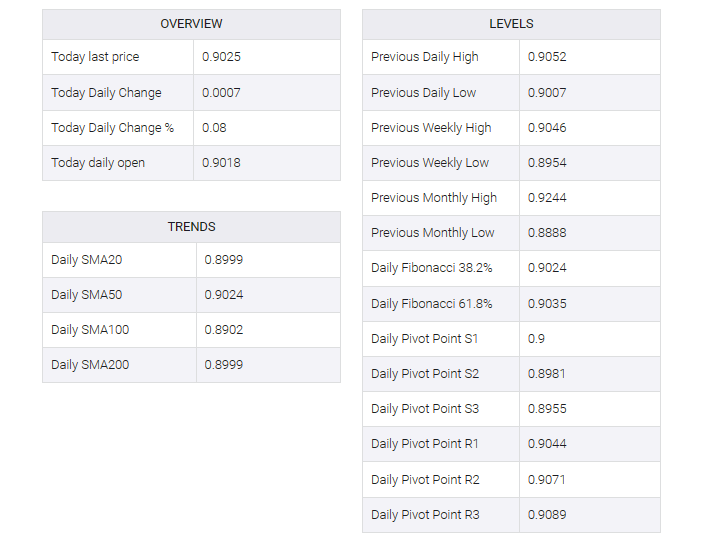

USD/CHF seems well-cushioned above 0.9000 ahead of US CPI data.

-

A stubborn inflation report may allow the Fed to emphasize raising interest rates further.

-

SNB Jordan is likely to emphasize keeping interest rates higher to keep inflation below 2%.

On Tuesday the USD/CHF pair was well supported above the psychological support of 0.9000. Swiss franc assets are trading broadly sideways as investors await US consumer price index (CPI) data for October, due out at 13:30 GMT.

S&P500 futures trade tepid in early European session, reflecting caution among market participants ahead of US inflation data. The US Dollar Index (DXY) rebounded from 105.60 but traded broadly on expectations that the release of consumer inflation data would provide fresh clues about the Federal Reserve’s (Fed) monetary policy actions.

According to consensus, monthly headline CPI rose at a nominal pace of 0.1% against a 0.4% increase in September. Annual CPI rose 3.3% vs. A 3.7% increase in September. The monthly and annual core CPI, which excludes volatile oil and food prices, expanded at a steady pace of 0.3% and 4.1%, respectively.

A stubborn core inflation report will allow Federal Reserve (Fed) policymakers to lean toward a more policy-tight narrative. Last week, Fed Chair Jerome Powell classified current monetary policy as insufficient to bring inflation down to 2%.

On the Swiss franc front, investors are awaiting a speech by Swiss National Bank (SNB) Chairman Thomas J. Jordan. SNB Jordan is expected to give guidance on possible monetary policy moves. Jordan may insist on keeping interest rates high to keep inflation below 2%.