-

USD/CHF dropped to a five-month low at 0.8557 on heightened speculation of the dovish Fed outlook.

-

Subdued US GDP data increased the chances of the Fed’s rate cuts in early 2024.

-

Middle East conflict could give rise to the demand for the safe-haven Swiss Franc.

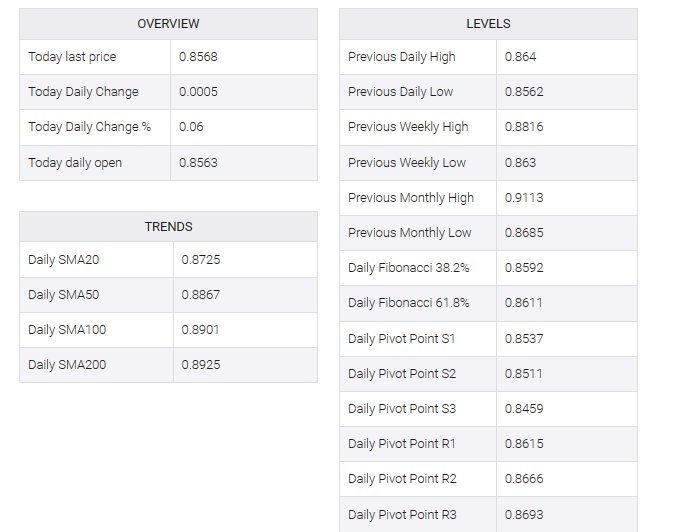

USD/CHF attempted to rebound from a 5-month low of 0.8557, trading near 0.8570 during Asian hours on Friday. The US dollar (USD) faced downward pressure on softer economic data from the United States (US) released on Thursday, along with heightened expectations of the Federal Reserve’s (Fed) dovish stance on rate cuts in the first quarter of 2024.

Subdued US data is adding weight to speculation of possible easing by the Fed. The US Bureau of Economic Analysis (BEA) showed that gross domestic product annualized (GDP) fell to 4.9% against an expected continuation of 5.2%. Meanwhile, Core Personal Consumption Expenditures (QoQ) slowed to 2.0% growth compared to the previous 2.3% growth.

However, initial jobless claims for the week ended December 15 were 205K, slightly below the 215K expected. Investors are awaiting key personal consumption – price index data, and the Michigan Consumer Sentiment Index for further indications of US economic conditions.

However, there is a nuanced view from Philadelphia Fed Bank President Patrick Harker. While Harker acknowledged that lowering rates will take time, he also expressed interest rate cuts. Harker cited the challenges businesses face in managing higher interest obligations as a key factor that could lower interest rates next year.

Continued blockades of the Suez Canal waterway due to Houthi attacks on ships in the Red Sea are fueling risk-averse sentiment. As a result, demand for the safe-haven Swiss franc (CHF) appears to have increased. The decision by major shipping companies, including Germany’s Hapag-Lloyd and Hong Kong’s OOCL, to clean up the Red Sea waterways, led by British Petroleum, underscores growing concerns about maritime safety in the region.

The quarterly bulletin from the Swiss National Bank (SNB) released on Wednesday indicated a proactive approach by the bank in managing currency dynamics. The SNB has expressed its readiness to be active in the foreign exchange market if necessary, indicating a stance ready to support the Swiss franc (CHF).