-

USD/CHF grinds higher after positing the first daily gains in three.

-

US policymakers’ discussion on bank deposit insurance allows markets to remain optimistic.

-

Yields rebound amid hawkish Fed bets, mixed feelings about banking sector fallout.

-

Swiss trade numbers, US housing data can entertain intraday traders.

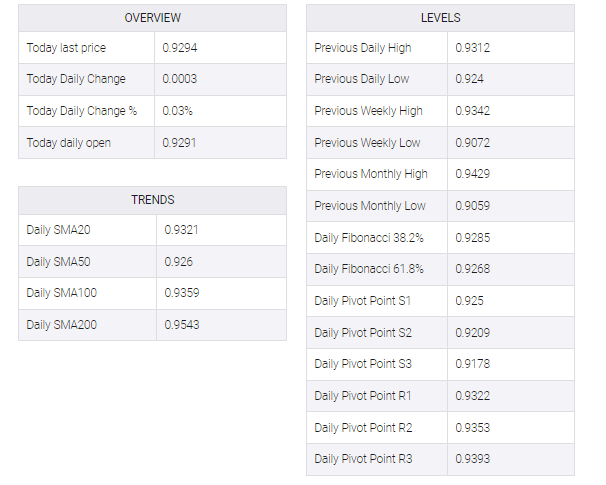

USD/CHF picks up bids to refresh intraday high as it extends the previous day’s gains, the first in three, to 0.9300 during early Tuesday morning in Europe.

The Swiss Franc (CHF) pair’s latest rebound could be linked to the US Dollar’s corrective bounce off the five-month low amid hawkish Fed bets. However, cautious optimism surrounding the latest banking industry updates, following a debacle in the US and Europe.

The US dollar index (DXY) bounced to its lowest level since early February, snapping a three-day downtrend marked the previous day, bidding lightly around 103.40 at press time. In doing so, the greenback’s gauge vs. the key Federal Open Market Committee (FOMC) of six major currencies looked for Monday’s late recovery in US Treasury bond yields as well as Fed bets to fuel buyers ahead of the monetary policy meeting. Up for release on Wednesday.

That said, Treasury bond yields remained subdued but the previous day’s bounce was short of a multi-day bounce as U.S. 10-year and two-year Treasury bond yields recovered from their lowest levels since September 2022 on Monday. Additionally, CME’s FedWatch tool pointed to a 0.25% chance of a Fed rate hike on Wednesday, down from 65% to 75% last week.

Alternatively, a Bloomberg headline suggests relief for traders amid the impending banking crisis, which in turn challenges the US dollar’s haven demand and could test the USD/CHF upside. “US officials are studying ways to temporarily expand Federal Deposit Insurance Corporation (FDIC) coverage to all deposits, a move sought by a coalition of banks that argues it is needed to weather a potential financial crisis,” reported Bloomberg. “Treasury Department staff are reviewing whether federal regulators have enough emergency authority to temporarily insure deposits above the current $250,000 cap in most accounts without formal consent from a deeply divided Congress,” the news outlet said, citing unnamed people with knowledge of the discussions.

It should be noted that the fears of the FDIC’s inability to cover the US bank deposits, due to the limitations of funds in the reserve, join the doubts surrounding the UBS-Credit Suisse deal to probe the risk-on mood amid a sluggish Asian session.

Amid these plays, S&P 500 Futures print mild gains to portray cautious optimism.

Looking ahead, February month trade numbers from Switzerland will precede the US second-tier housing data to entertain intraday USD/CHF traders. However, major attention will be given to the Fed versus Swiss National Bank (SNB) play as the latter previously advocated policy pivot.

Technical analysis

A two-week-old descending resistance line challenge USD/CHF bulls around 0.9300.