-

USD/CHF experienced gains but is still remaining under pressure ahead of US economic data.

-

Swiss inflation indicator showed a reduction in producer and import costs.

-

US upbeat CPI data contributed support for the USD/CHF pair.

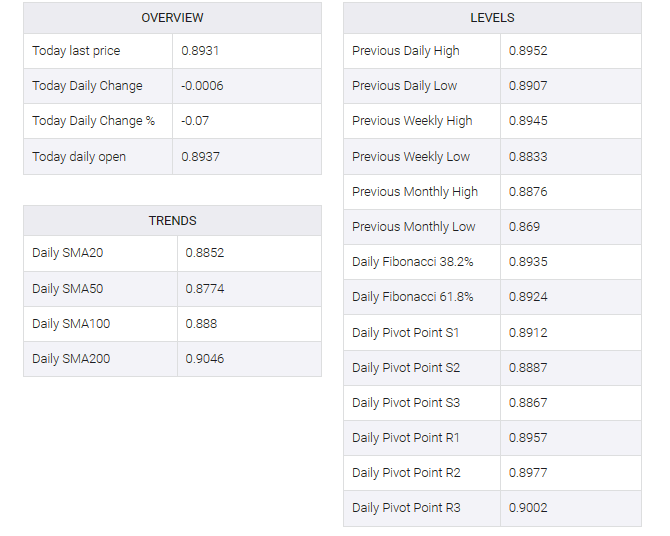

USD/CHF recovered from intraday losses to trade around 0.8930 during the European session on Thursday. However, the pair remains under pressure ahead of further economic data from the United States (US) to be released later in the North American session.

US Commerce Secretary Gina Raimondo is scheduled to meet with chief executives of major American corporations on Tuesday following her recent visit to China. This renewed tension in the US-China trade relationship could potentially influence traders to buy safe haven assets such as the Swiss Franc (CHF).

Switzerland’s Federal Statistics Office released producer and import prices (August) on Thursday. The Swiss inflation index fell 0.2% on a monthly basis, against an expected increase of 0.1% and a previous reading of a 0.1% decline. The annual rate, however, declined to 0.8% against the previous decline of 0.6%.

Moreover, the USD/CHF pair recorded gains on the previous day, which can be attributed to the upbeat US Consumer Price Index (CPI) data.

The US inflation figure rose to an annual rate of 3.7% from 3.2% previously, beating the market’s expected rate of 3.6% for August. Additionally, the monthly core consumer price index (CPI) improved to 0.3% from 0.2% previously, against market expectations of remaining unchanged.

However, the annual core inflation rate remained steady at an expected rate of 4.3%, down from 4.7% previously. The inflation report suggests that overall inflation may moderate, with the core Consumer Price Index (CPI) remaining relatively unchanged.

Investors appear to be pricing in the possibility of the US Federal Reserve (Fed) maintaining a dovish stance at its September meeting, which could put downward pressure on the US dollar (USD).

The CME FedWatch tool suggests a 40% chance the US Federal Reserve (Fed) will implement a 25 basis point (bps) rate hike in November. Investors are becoming more cautious about the potential for such a move as they assess the changing economic overview and Fed communications.

The US Dollar Index (DXY) pared some of its earlier losses and is trading near 104.70. This rebound in the DXY is being supported by a recovery in US Treasury yields, with the 10-year US bond yield rising to 4.26% by press time.

Market participants are likely to release the core Producer Price Index (PPI) and August retail sales figures from the US. These economic indicators have the potential to provide valuable insights into the state of economic activity in the country, which can influence trading decisions and market sentiment.